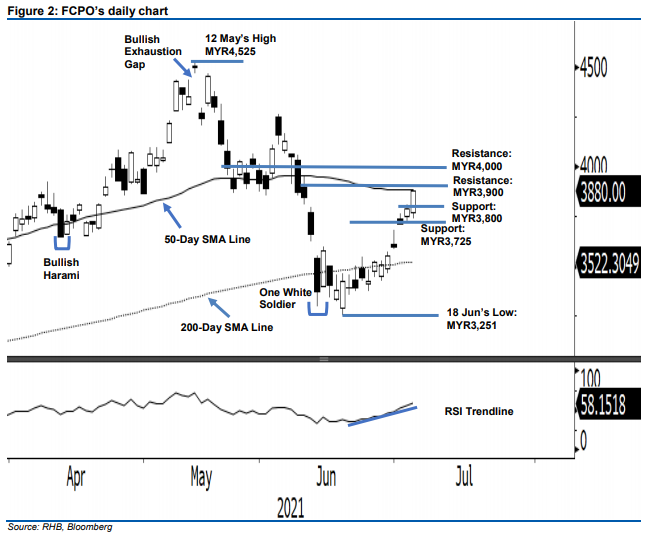

FCPO - Bulls Accelerate Above The MYR3,800 Level

rhboskres

Publish date: Tue, 06 Jul 2021, 09:59 AM

Maintain long positions. A strong upward movement was seen yesterday after the FCPO soared MYR91 to close at MYR3,880 in an attempt to breach above the 50-day SMA line of MYR3,886. It commenced the session slightly weaker at MYR3,769 before testing the intraday low of MYR3,737. The commodity then reversed its direction and progressed higher to tap the intraday peak of MYR3,885, just before closing at MYR3,880. The long white candlestick formation has enhanced the upward trajectory in the medium term, on top of the strenghtening of the RSI near the 60% level. For the immediate term, mild profit taking is likely to be seen near the 50-day SMA line. As long as the index is still trading above the trailing-stop level, we expect the positive momentum to persist, and hence, stick to our positive trading bias.

We suggest traders to stay in long positions. We initiated these at 25 Jun’s close of MYR3,520. To manage risks, the trailing-stop threshold is pegged at MYR3,703.

The immediate support level is revised higher at MYR3,800 – the psychological level, followed by MYR3,725, or the low of 2 Jul. Towards the upside, the next two resistance levels are also revised at MYR3,900 and MYR4,000 – above the 50-day SMA line.

Source: RHB Securities Research - 6 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024