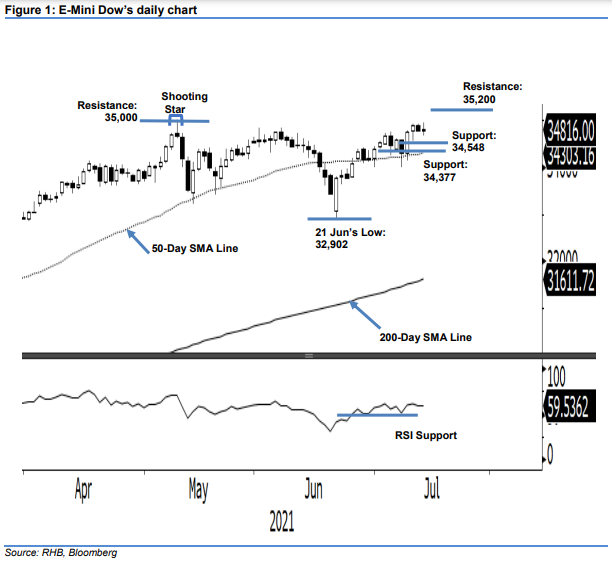

E-Mini Dow - Consolidating Sideways Before the 35,000-Pt Mark

rhboskres

Publish date: Thu, 15 Jul 2021, 09:50 AM

Maintain long positions. Despite a brief rally to test the 35,000-pt resistance, the E-Mini Dow failed to retain all its intraday gains – it only managed to add 40 pts and settle at 34,816 pts. After it started Wednesday’s session at 34,779 pts, it dipped to the session low at 34,667 pts. During the European session, the bulls rallied to test the session high at 34,946 pts, only to pare the gains during the late session, where the index settled at 34,816 pts. While there was mild selling pressure during the early session, the “lower shadow” eventually stayed above the nearest support level of 34,548 pts and formed a “higher low”. This showed the selling pressure was not great and should be interpreted as mild profit-taking by the bears – merely a healthy pullback with an intact uptrend. As such, we make no changes to our positive trading bias.

We recommend traders keep to the long positions initiated at 34,082 pts, or the closing level of 24 Jun. To protect profits and also cap the downside risks, a trailing-stop threshold is implemented at 34,150 pts.

The immediate support is established at 34,548 pts, or the low of 12 Jul, and followed by 34,377 pts – the low of 1 Jul. Meanwhile, the resistance levels stick to 35,000 pts – 2021’s high – and 35,200 pts, ie the uncharted new high

Source: RHB Securities Research - 15 Jul 2021