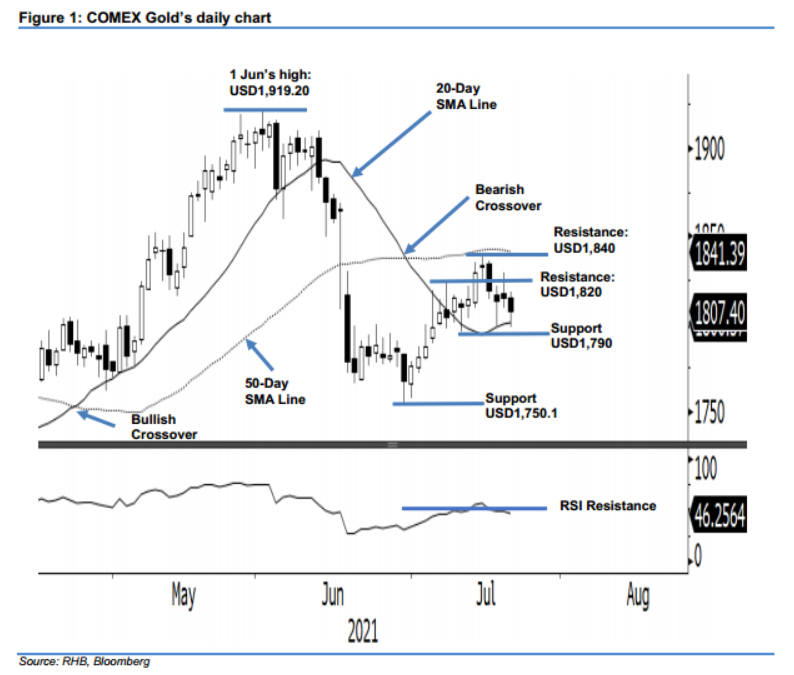

COMEX Gold - Held Up by the 20-Day SMA Line

rhboskres

Publish date: Thu, 22 Jul 2021, 05:42 PM

Maintain long positions. The COMEX Gold continued its consolidation movement, building an interim support near the 20-day SMA line. The December Gold futures contracts dipped USD7.80 yesterday to settle at USD1,807.40. It initially started the session at USD1,814.70 and rose to its intraday high at USD1,818.10. After that, the brief momentum faded and was replaced by selling pressure that brought the commodity to the USD1,798.30 session low before the close – mild buying interest was also witnessed along the 20-day SMA line. If the moving average fails to support the COMEX Gold, it may drift lower to seek stronger support. With the RSI staying below the 50% threshold, the commodity may continue its sideways movement until the consolidation is over. At this juncture, the bulls are still holding the line. Hence, we keep to our positive trading bias.

Traders are advised to maintain the long positions initiated at USD1,794.20, or the closing level of 6 Jul. To manage the trading risks, the stop-loss threshold is set at USD1,790.

The support levels remain at USD1,790 and USD1,750.10, ie 29 Jun’s low. Conversely, the immediate resistance is revised to USD1,820, followed by the USD1,840 round figure.

Source: RHB Securities Research - 22 Jul 2021