WTI Crude - Reclaiming the 50-Day SMA Line

rhboskres

Publish date: Thu, 22 Jul 2021, 05:43 PM

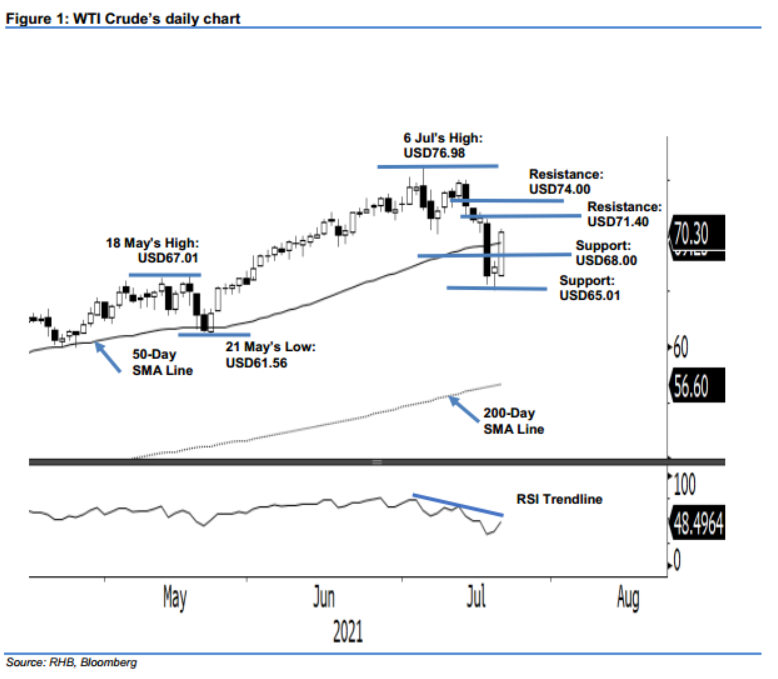

Trailing stop triggered; initiate long positions. The WTI Crude September futures contracts saw a sharp rebound yesterday, soaring USD3.10 to settle at USD70.30 – a level above the 50-day SMA line. The commodity initially started at USD66.45 and immediately progressed higher on strong buying interest. It tested the USD70.51 intraday high before the close. With the long white candlestick pattern, the bulls trumped the bears and saw strong support established at the USD65.01 level. To retain the bullish momentum, the WTI Crude needs to stay above the USD68.00 immediate support. Since the commodity has breached our previous stop-loss level and returned to its upward movement trajectory, we shift back to a positive trading bias.

We closed out the short positions initiated at USD72.20 – the closing level of 7 Jul – after the trailing-stop mark at USD70.00 was triggered. Conversely, we initiate long positions at the closing level of 21 Jul. To mitigate trading risks, an initial stop-loss threshold is set at USD66.44, ie the low of 21 Jul.

The nearest support level is revised to the USD68.00 whole number, followed by USD65.01, ie the low of 20 Jul. The immediate resistance is changed to USD71.40 – 19 Jul’s high – followed by the USD74.00 whole number.

Source: RHB Securities Research - 22 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024