Hang Seng Index Futures - Testing the Immediate Resistance Level

rhboskres

Publish date: Fri, 23 Jul 2021, 06:12 PM

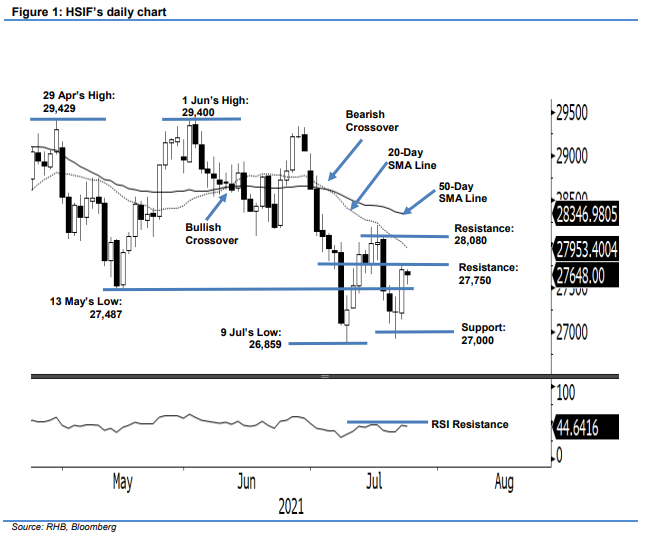

Maintain short positions. The HSIF staged a strong rebound yesterday, rising 479 pts to settle the day session at 27,705 pts – forming a long white body candlestick. It retraced mildly during the evening session and last traded at 27,648 pts. The bullish candlestick indicates that positive sentiment is growing. However, the bulls were cautious when the index was about to test the immediate resistance at 27,750 pts. Since the 50-day SMA line is signalling a bearish trend, the index will tend to form “lower highs”, whereby selling pressure will emerge near the resistances pegged at 27,750- and 28,808-pt levels. If they manage to take out these levels, the HSIF will revert to an uptrend mode. Otherwise, expect more selling pressure ahead. The 20-day SMA line is currently trending lower which – in confluence with the resistance level – is exerting selling pressure on the index. Hence, we stay negative trading bias.

Traders are advised to maintain the short positions initiated at 27,469 pts, or the closing level of 19 Jul. To manage the risks, the initial stop-loss threshold is placed at 28,080 pts.

The immediate support is established at 27,000 pts, followed by the 26,600-pt whole number. On the upside, the immediate resistance level is expected at the 27,750-pt round figure and followed by 28,080 pts, ie 19 Jul’s high.

Source: RHB Securities Research - 23 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024