COMEX Gold - Retesting the Immediate Support Level

rhboskres

Publish date: Fri, 23 Jul 2021, 06:12 PM

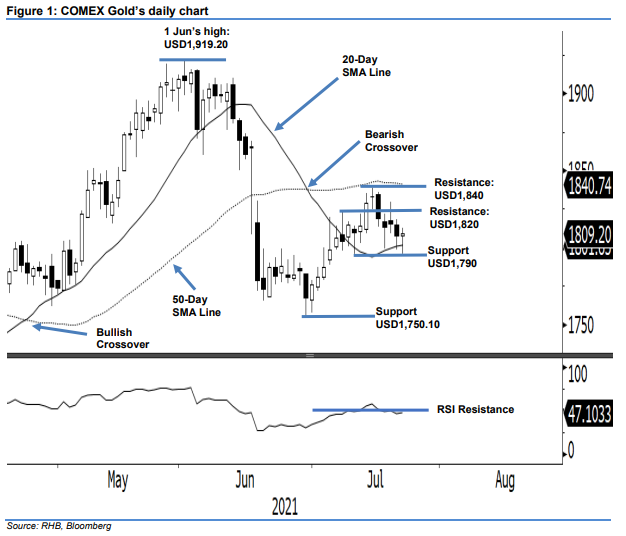

Maintain long positions. The COMEX Gold continued building its interim support above the 20-day SMA line yesterday – tapping the support level below the average line before bouncing off above. The precious metal rose USD1.80 to close at USD1,809.20. It opened the session at USD1,807.8 and then gradually fell to its intraday low at USD1,796. During the late session, a strong buying interest emerged, which lifted the precious metal to the USD1,812.30 session high before it settled at USD1,809.20. Since the buying interest emerged strongly to sustain above the 20-day SMA line (forming a long lower shadow candlestick), the buying momentum may continue to bounce off higher in the later sessions. While the RSI is trading slightly below the 50% level, the COMEX Gold may continue its sideways movement in the immediate term before rebounding higher towards its immediate resistance. As such, we stick to our positive trading bias.

Traders are recommended to stay in long positions initiated at USD1,794.20 – 6 Jul’s close. To manage the trading risks, the stop-loss threshold is placed at USD1,790.

The immediate support level is set at USD1,790 and followed by USD1,750.10, or 29 Jun’s low. Meanwhile, the resistance levels remain unchanged at USD1,820 and the USD1,840 round figure.

Source: RHB Securities Research - 23 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024