WTI Crude - Climbing Higher Above the 50-Day SMA Line

rhboskres

Publish date: Fri, 23 Jul 2021, 06:12 PM

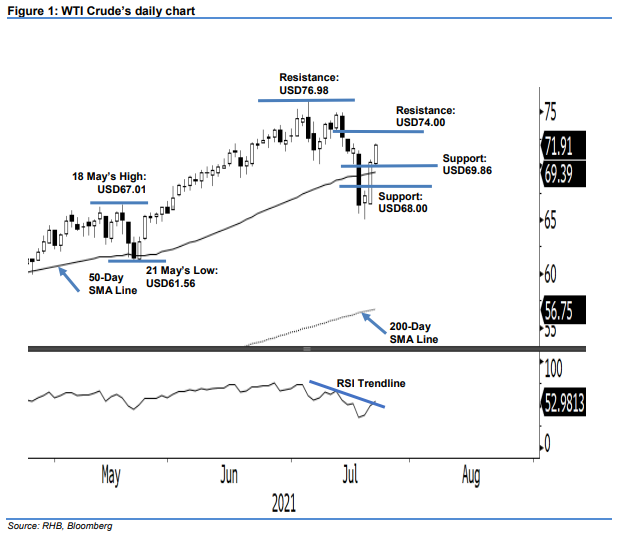

Maintain long positions. The WTI Crude moved higher on bullish momentum, rising USD1.61 to settle at USD71.91 – firming its position above the 50-day SMA line. On Thursday, the commodity started the session at USD70.22 and progressed higher to test the intraday high at USD72.03 just before its close. With the latest white body candlestick, the bullish momentum has been strengthened – this is coupled with the RSI crossing above the 50% threshold. Although the momentum is strong now, we do not rule out the possibility that there might be a profittaking activities ahead, with 50-day SMA line providing strong support. As long as the stop-loss threshold remains intact, we expect the WTI Crude to move higher. Hence, we stick to our positive trading bias.

We recommend traders shift to long positions initiated at USD70.30, ie the closing level of 21 Jul. For risk management, we adjust the stop-loss threshold higher to USD67.61, or the high of 20 Jul.

The nearest support level is marked at USD69.86 – the low of 22 Jul – which is followed by the USD68.00 whole number. The immediate resistance is updated to the USD74.00 whole number and followed by USD76.98, ie the high of 6 Jul.

Source: RHB Securities Research - 23 Jul 2021