FKLI - Attempting To Stage a Technical Breakout

rhboskres

Publish date: Fri, 23 Jul 2021, 06:13 PM

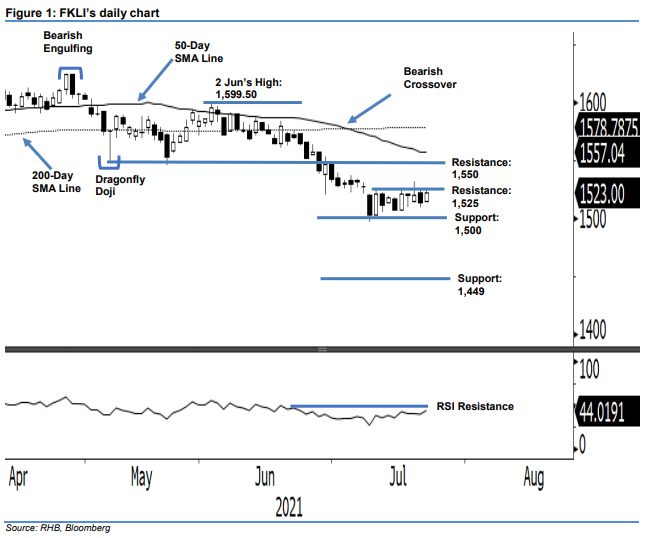

Maintain short positions. Yesterday, mild buying interest lifted the FKLI by 9.50 pts to its close of 1,523.0 pts – which is still within the sideways consolidation zone capped at 1,525 pts. The index opened at 1,515.0 pts, and rose to close at 1,523 pts after tapping the intraday high of 1,525 pts. As such, the bulls just knocked the bears after forming “bullish engulfing” pattern yesterday – thereby boosting investor sentiment. The RSI indicator, which curved higher yesterday, also indicates that the recent sideways movement is likely to see a breakout in the coming sessions. On the other hand, if the index drops below 1,500 pts, a deep correction may loom ahead. Until it breaks above the immediate resistance, we make no change to our negative trading bias.

Traders should remain in short positions. We initiated these at 1,569.50 pts, or 11 Jun’s close. To control trading risks, we placed the trailing-stop at 1,525 pts, which is the immediate resistance.

The nearest support level is at 1,500 pts, then 1,449 pts or Nov 2020’s low. Conversely, the immediate resistance level is at 1,525 pts (9 Jul’s high), followed by 1,550 pts or the low of 26 Feb.

Source: RHB Securities Research - 23 Jul 2021