WTI Crude - Firming Positions Above the 50-Day SMA Line

rhboskres

Publish date: Mon, 26 Jul 2021, 09:27 AM

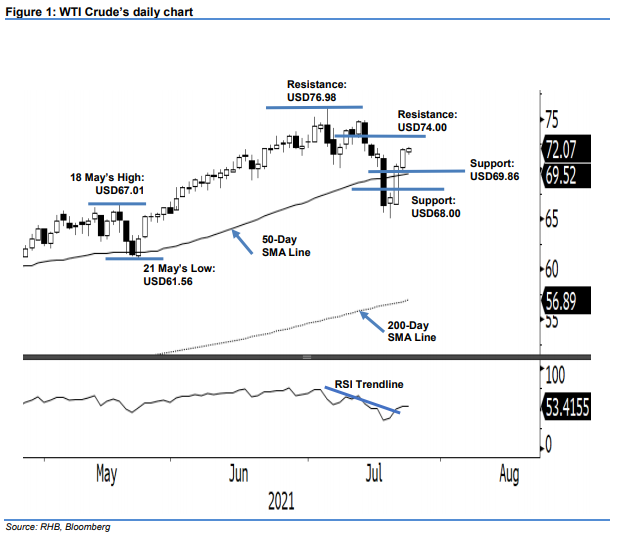

Maintain long positions. The WTI Crude advanced higher last Friday, adding USD0.61 to settle at USD72.07 – continuing the upward movement since claiming back the 50-day SMA line. It opened at USD71.71 and saw buying interest emerge near the USD71.39 day low. During the US session, the WTI Crude rebounded from the day low to test the USD72.21 day high and closed at USD72.07. The white body candlestick with lower shadow showed the bulls are in control of the upward movement. Amidst the RSI breaching the 50% threshold and pointing upwards, the positive momentum is strengthening – leading the black gold to test the USD74.00 immediate resistance. We expect mild selling pressure to reemerge when the WTI Crude approaches the immediate resistance, but believe USD69.86 provides a strong immediate support towards the bullish structure. We keep our positive trading bias.

Traders are advised to keep the long positions initiated at USD70.30, ie the closing level of 21 Jul. For riskmanagement purposes, stop-loss mark is raised to USD68.50.

The nearest support level is set at USD69.86 – the low of 22 Jul – and followed by the USD68.00 whole number. The immediate resistance is pegged at the USD74.00 whole number, followed by USD76.98, ie 6 Jul’s high.

Source: RHB Securities Research - 26 Jul 2021