FKLI - The Emergence Of The Negative Momentum

rhboskres

Publish date: Tue, 27 Jul 2021, 09:36 AM

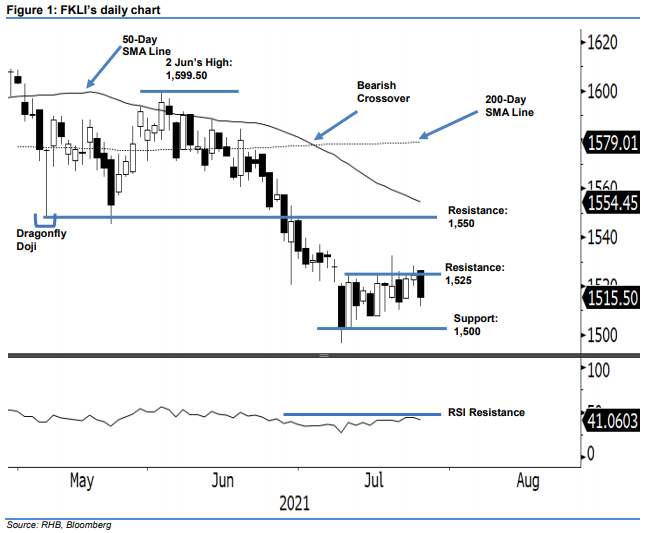

Maintain short positions. Despite having a strong opening and gapping above the immediate resistance, the FKLI failed to establish a foothold above the 1,525-pt resistance, falling 9 pts to settle at 1,515.5 pts. The index started the session strong at 1,526.50 pts, but fell sharply in the morning session. The negative momentum continued in the afternoon session where it touched the session’s low of 1,511.5 pts before closing at 1,515.5 pts. The latest price action reaffirms the 1,525-pt resistance level is capping the index’s upward movement. Coupled with the RSI rounding downwards, there is a possibility of the negative momentum accelerating in the coming sessions. Unless the momentum reverses to breach the immediate resistance level, we maintain our negative trading bias.

Traders are recommended to stay in short positions. We initiated these at 1,569.50 pts, or 11 Jun’s close. To control trading risks, we place the trailing-stop level at 1,525 pts – the immediate resistance level.

The nearest support point is seen at 1,500 pts – the psychological level, followed by 1,449 pts, Nov 2020’s low. Meanwhile, the resistance levels are set at 1,525 pts (9 Jul’s high) and 1,550 pts – the low of 26 Feb.

Source: RHB Securities Research - 27 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024