WTI Crude - Consolidating Above the 50-day SMA Line

rhboskres

Publish date: Tue, 27 Jul 2021, 09:37 AM

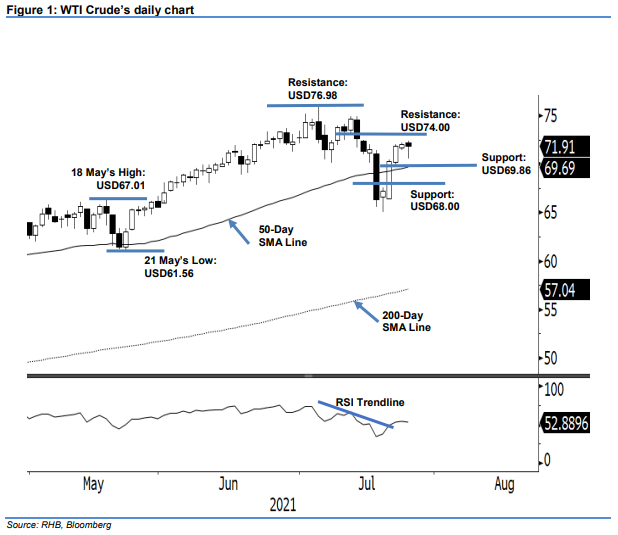

Maintain long positions. The WTI Crude saw mild profit-taking yesterday, falling a marginal USD0.16 lower to USD71.91. It initially opened at USD72.18 and saw the bears taking profit, causing it to fall to the USD70.56 session low. Buying interest emerged again during the European session, lifting the commodity higher to close at USD71.91 – where a black body candlestick with long lower shadow was printed. With the latest price action, the bears may be tempted to take profit if prices approach the USD74.00 resistance level. Meanwhile, we expect buying pressure near the 50-day SMA line. Hence, it is likely that the WTI Crude will move sideways in the coming sessions with neutral momentum. As long as the commodity continues to trade above the 50-day SMA line, the uptrend structure will stay intact. Premised on this, we hold on our positive trading bias.

We recommend traders stick with the long positions initiated at USD70.30, ie the closing level of 21 Jul. To manage trading risks, stop-loss mark is raised to the USD69.00 whole number.

The nearest support level is marked at USD69.86 – the low of 22 Jul – and followed by the USD68.00 whole number. The immediate resistance is set at the USD74.00 whole number and followed by USD76.98, ie 6 Jul’s high.

Source: RHB Securities Research - 27 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024