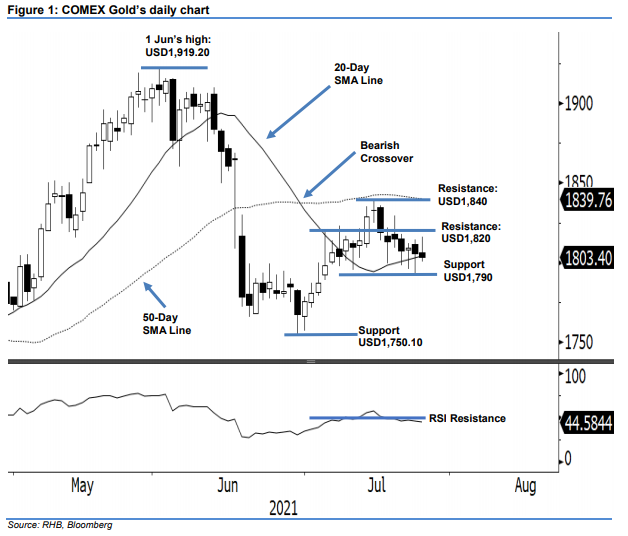

COMEX Gold - Falling Below the 20-Day SMA Line

rhboskres

Publish date: Tue, 27 Jul 2021, 09:38 AM

Maintain long positions. Despite attempting to move higher during the early session yesterday, the COMEX Gold reversed and pared all gains to close USD2.50 weaker at USD1,803.40, ie slightly below the 20-day SMA line. It initially opened the session at USD1,806.40 and then rose strongly to hit the intraday high at USD1,816.10 before the selling momentum kicked in to reverse the commodity during the later session. It then dropped from the top towards the day low of USD1,800.20 before closing at USD1,803.40. The latest price movement of the long upper shadow – a bearish momentum candlestick – implies that the immediate selling pressure is resilient enough to drag the COMEX Gold further below the 20-day SMA line towards the next support level at USD1,790. This is also supported by the RSI, which is curving downwards below the 45% level. Since the commodity has yet to breach below the USD1,790 immediate support level, we stick to our positive trading bias.

We suggest traders maintain the long positions initiated at USD1,794.20, or 6 Jul’s close. To mitigate the trading risks, the stop-loss threshold is pegged at USD1,790.

The immeidiate support level is set at USD1,790, followed by USD1,750.10, ie 29 Jun’s low. Meanwhile, the resistance levels are fixed at USD1,820 and the USD1,840 round figure

Source: RHB Securities Research - 27 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024