COMEX Gold - Continue Hovering Near the Immediate Support

rhboskres

Publish date: Wed, 28 Jul 2021, 04:49 PM

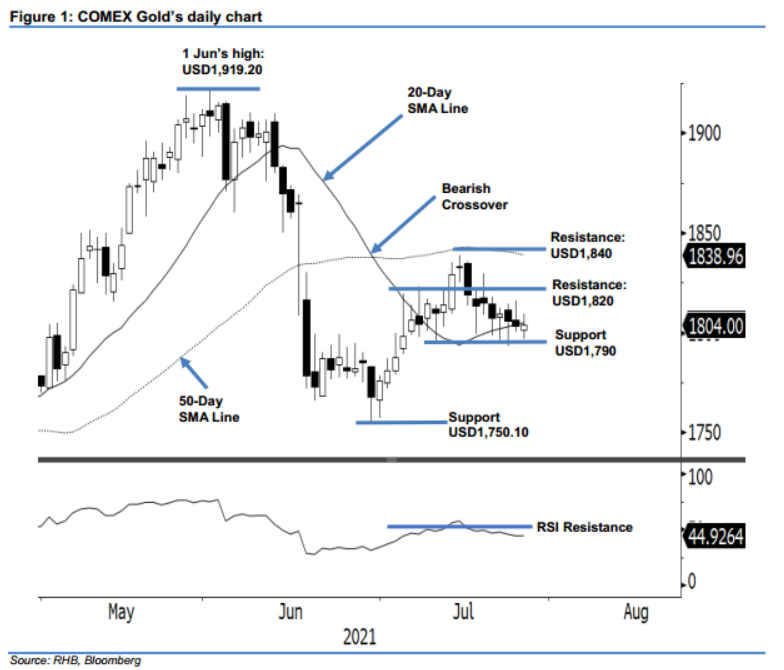

Maintain long positions. Following a quiet session yesterday, the COMEX Gold marginally added USD0.60 to close at USD1,804. It initially started Tuesday’s session at USD1,801.50. After gyrating between the day high and low of USD1,809.50 and USD1,796.90, it closed at USD1,804. Despite forming a white body candlestick, we observed it last trading below the 20-day SMA line. This flashes a cautious note, ie the COMEX Gold’s momentum is faltering and sentiment may turn bearish. If the immediate support gives way, the commodity’s momentum will decelerate, possibly correcting lower to test USD1,750.10, ie the low of 30 Jun. Meanwhile, in light of the RSI trending below the 50% threshold, we expect the COMEX Gold to retain its sideways movement in the immediate term. We maintain our positive trading bias until the stop-loss threshold is breached.

We recommend traders maintain the long positions initiated at USD1,794.20, or 6 Jul’s close. To mitigate the downside risks, the stop-loss threshold is fixed at USD1,790.

The immediate support level remains at USD1,790, followed by USD1,750.10, ie 29 Jun’s low. Meanwhile, the immediate resistance level is sighted at USD1,820, with the higher hurdle at the USD1,840 round figure.

Source: RHB Securities Research - 28 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024