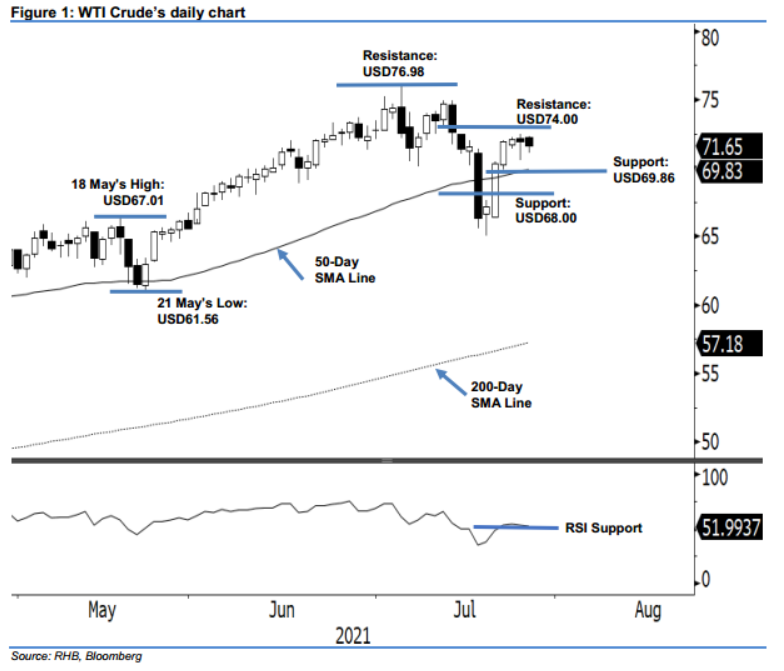

WTI Crude - Mild Profit-Taking Above the 50-day SMA Line

rhboskres

Publish date: Wed, 28 Jul 2021, 04:50 PM

Maintain long positions. The WTI Crude continued its mild profit-taking during its second consecutive session yesterday, declining slightly by USD0.26 to settle at USD71.65. It started Tuesday’s session at USD72.22 before bouncing higher during the early Asian trading hours to hit the USD72.33 session high before selling interest emerged during the mid session. It then moved downwards to touch the USD71.08 day low before bouncing off during the US trading hours – it closed with a black candlestick with a lower shadow. The candlestick pattern that emerged suggests the commodity is building an interim base above the immediate support. Hence, we expect the buying pressure to persist while it consolidates sideways in the coming sessions. As such, we maintain our positive trading bias.

We advise traders to stay in the long positions initiated at USD70.30, which was the closing level of 21 Jul. To manage trading risks, the stop-loss thereshold stays unchanged at the USD69.00 whole number.

The immediate support level is set at USD69.86 – the low of 22 Jul – and followed by the USD68.00 whole number. The immediate resistance is pegged at the USD74.00 whole number, followed by USD76.98, ie 6 Jul’s high.

Source: RHB Securities Research - 28 Jul 2021