WTI Crude - Bullish Momentum Emerges

rhboskres

Publish date: Thu, 29 Jul 2021, 05:46 PM

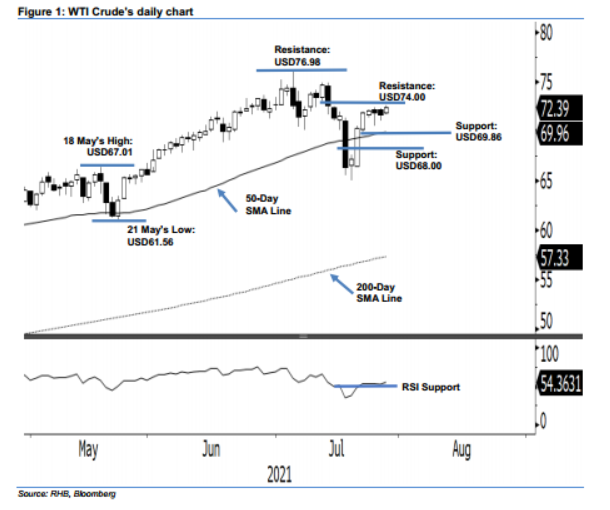

Maintain long positions. After mild profit-taking recently, the WTI Crude reversed its momentum yesterday, rising USD0.74 to close at USD72.39. It opened Wednesday’s session with a gap up to USD71.90 and continued its positive momentum throughout the Asian trading hours to hit the USD72.60 session high. Profit-taking activity kicked in during the European trading hours, with the commodity tapping the day’s low at USD71.70 before bouncing off strongly during the US trading hours to reclaim the territory close to its intraday high. It closed at USD72.39. The bullish candlestick, which emerged yesterday after the recent building of an interim base, suggests that buying momentum has started to propel the commodity above the immediate resistance of USD74.00. As such, we keep our positive trading bias.

We suggest traders maintain the long positions initiated at USD70.30 – the closing level of 21 Jul. To manage trading risks, the stop-loss is revised higher to USD69.86, which is the immediate support.

The support levels are pegged at USD69.86 (22 Jul’s low), followed by USD68.00. The immediate resistance is set at USD74.00, followed by USD76.98 or 6 Jul’s high.

Source: RHB Securities Research - 29 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024