E-Mini Dow - Mild Selling Pressure Continues

rhboskres

Publish date: Thu, 29 Jul 2021, 05:47 PM

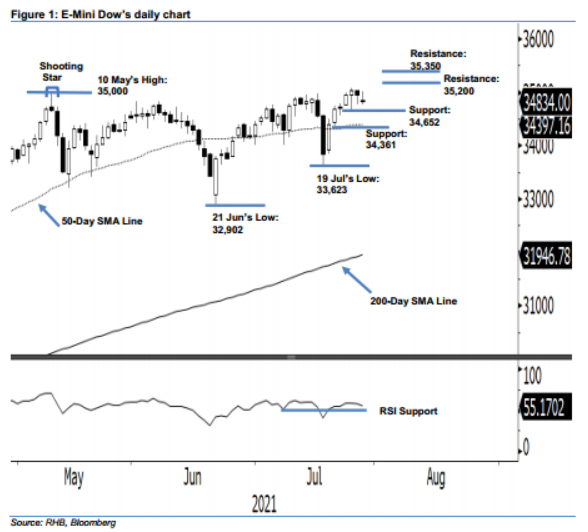

Maintain long positions. Yesterday, the E-Mini Dow saw continued profit-taking for the second consecutive session, falling 119 pts to close at 34,834 pts – reacting negatively to last night’s Federal Open Market Committee (FOMC) statement. The index began at 34,844 pts and moved higher to hit its intraday high of 35,018 pts, and later moved sideways during the Asian trading hours. During the US trading hours, it saw profit-taking activity towards the end of the session, falling to the day’s low of 34,764 pts before closing. This was also supported by the RSI weakening gradually despite staying above the 50% level – indicating that buying interest remains weak in the immediate term, despite positive movement in the medium term. Hence, we stick to our opinion that the index will move sideways above the 34,652-pt nearest support level in the coming sessions. Unless the index reverses below the stop-loss point, we will maintain our positive trading bias.

Traders are advised to remain in the long positions initiated at 34,709 pts, or the closing level of 22 Jul. To mitigate trading risks, the stop-loss threshold is set at 34,557 pts, which was 22 Jul’s low.

The support levels are maintained at 34,652 pts (26 Jul’s low) and 34,361 pts, or 21 Jul’s low. Meanwhile, the immediate resistance level is set at 35,200 pts, followed by 35,350 pts, which is uncharted territory.

Source: RHB Securities Research - 29 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024