WTI Crude - the Positive Momentum Persists

rhboskres

Publish date: Fri, 30 Jul 2021, 05:18 PM

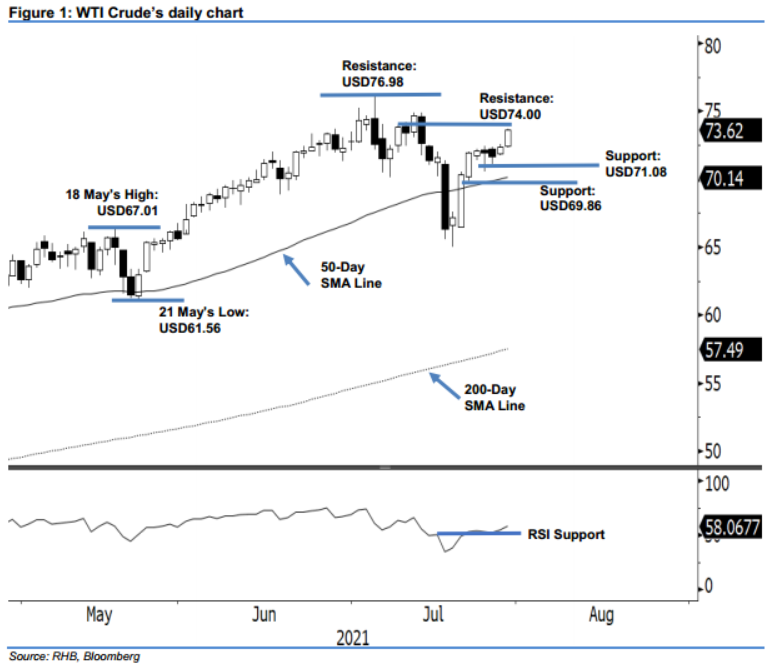

Maintain long positions. After the momentum reversed on Wednesday, the WTI Crude continued its stronger momentum yesterday, increasing USD1.23 to settle at USD73.62. The commodity started the session neutral at USD72.40 before retracing lower softly to tap the day low at USD72.26 before the Asian trading hours started. During the latter trading session, the WTI Crude saw strong positive momentum, which shifted it upwards – it then saw pull back during the European trading hours. The positive momentum then re-emerged during the US trading sesson, where it hit its day high at USD73.68 before closing at USD73.62. The strong bullish candlestick – a long white candle that appeared yesterday – suggests the bullish sentiment is imminent, with the bulls eyeing the USD74.00 immediate resistance. Unless the momentum is reversed, we stick to our positive trading bias.

We advise traders remain in the long positions initiated at USD70.30, ie the closing level of 21 Jul. To manage the trading risks, an initial trailing stop is set at USD71.08 – 27 July’s low – or the revised immediate support.

The immediate support level is revised higher at USD71.08 – 27 Jul’s low – and followed by USD69.86, ie 22 Jul’s low. The resistance levels are unchanged at USD74.00 and USD76.98, or 6 Jul’s high.

Source: RHB Securities Research - 30 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024