WTI Crude - The Bullish Momentum Is Intact

rhboskres

Publish date: Mon, 02 Aug 2021, 09:44 AM

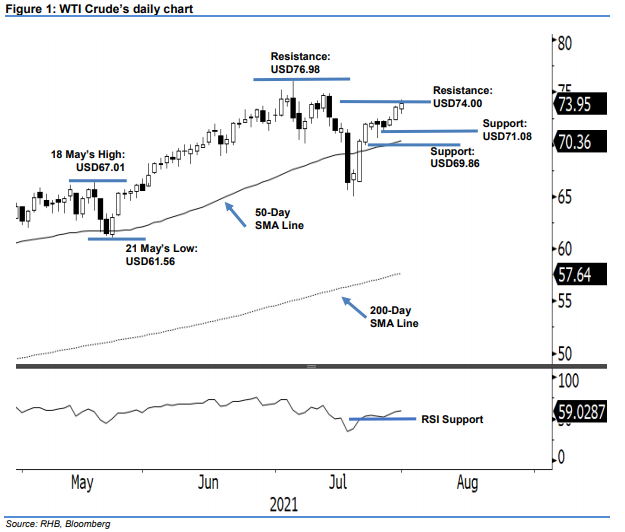

Maintain long positions. The WTI Crude continued its bullish momentum last Friday for three consecutive sessions, climbing a mild USD0.33 to close at USD73.95. It began Friday’s session slightly lower at USD73.41 before gradually moving lower to touch the day’s low at USD72.93 towards the mid-Asian trading hours. Then, the buying interest picked up and saw strong positive momentum – shifting the WTI Crude upwards towards the midUS trading hours to tap the USD74.23 day high. It then saw pullback towards the end of the session to settle at USD73.95. The three consecutive bullish candlesticks represent the “Three White Soldiers” pattern, signifying the uptrend stays intact in the medium term to surpass the USD74.00 immediate resistance. Nevertheless, we do not discount the possibility of mild profit-taking in the coming sessions. For now, we maintain our positive trading bias.

We advise traders maintain long positions initiated at USD70.30, or the closing level of 21 Jul. To manage the trading risks, the trailing stop is pegged at USD71.08 – 27 Jul’s low – or the immediate support level.

The immediate support level is unchanged at USD71.08, ie 27 Jul’s low, and followed by USD69.86, or 22 Jul’s low. The resistance levels are set at USD74.00 and USD76.98, ie 6 Jul’s high.

Source: RHB Securities Research - 2 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024