Hang Seng Index Futures - Testing the Immediate Support Level

rhboskres

Publish date: Mon, 02 Aug 2021, 09:45 AM

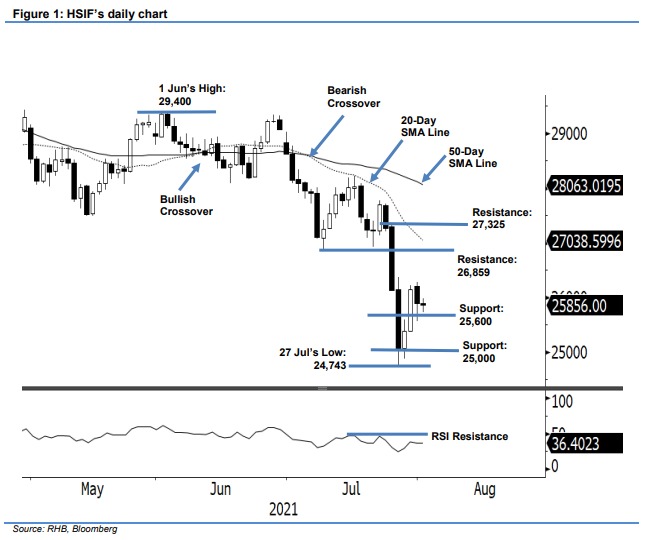

Maintain long positions. The HSIF’s August futures contracts rebounded from the immediate support level last Friday to settle the day session at 25,897 pts. During the intraday price action, it once breached below the 25,600-pt support level to as low as the 25,559-pt day low. It then rebounded to close at 25,897 pts with a long lower shadow. The index changed little during the evening session and last traded at 25,856 pts. The lastest price action reaffirmed that 25,600 pts will act as a strong support level to lift the technical rebound higher. Breaching this level again will dent sentiment. With the RSI indicator yet to cross the 50% threshold, it is likely that the HSIF will consolidate above its immediate support level. With the stop loss staying intact, we stick to our positive trading bias.

Traders should retain the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To manage the trading risks, the stop-loss mark is revised to the 25,330-pt level.

The immediate support fixed at 25,600 pts, followed by the 25,000-pt psychological level. The immediate resistance mark is sighted at 26,859 pts – the low of 9 Jul – and followed by 27,325 pts, ie the high of 26 Jul.

Source: RHB Securities Research - 2 Aug 2021