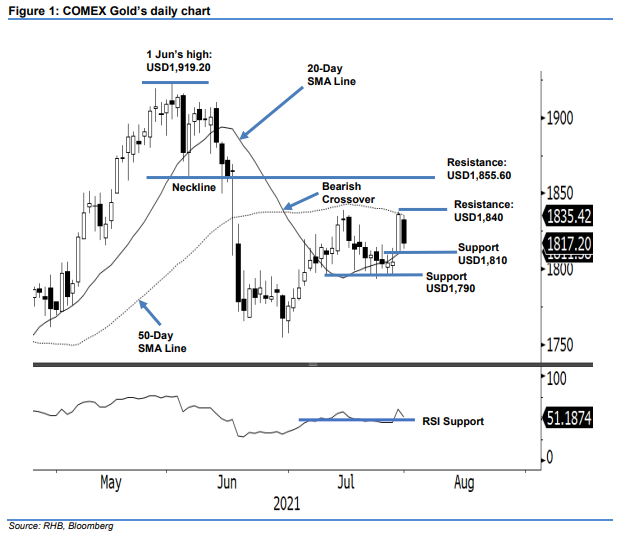

COMEX Gold - Falling Back to the 20-day SMA Line Support

rhboskres

Publish date: Mon, 02 Aug 2021, 09:45 AM

Maintain long positions. The COMEX Gold’s upside momentum paused at the 50-day SMA line, declining USD18.60 to close at USD1,817.20. Following a positive session on Thursday, the commodity started Friday’s session weaker at USD1,832.50. After it tested the USD1,835.50 intraday high, the bears were eager to take profit, which see the COMEX Gold plunge to the USD1,813.10 session low before rebounding mildly to close at USD1,817.20. With strong profit-taking acitivites taking place, we need to monitor the price action at the USD1,810 support. A typical bullish or upward movement will see it continuing to print a “higher low” or long lower shadow. In the event the immediate support level gives way and breaches the 20-day SMA line, sentiment will become bearish again. As long as the stop-loss threshold stays intact, we maintain our positive trading bias.

Traders are recommended to stick with the long positions initiated at USD1,794.20, or 6 Jul’s close. To control trading risks, the stop-loss threshold is fixed at USD1,790.

The immediate support level remains at USD1,810, followed by a lower support at USD1,790. On the upside, the immediate resistance level is sighted at USD1,840. A higher hurdle is at USD1,855.60, ie the neckline that formed on 4 Jun.

Source: RHB Securities Research - 2 Aug 2021