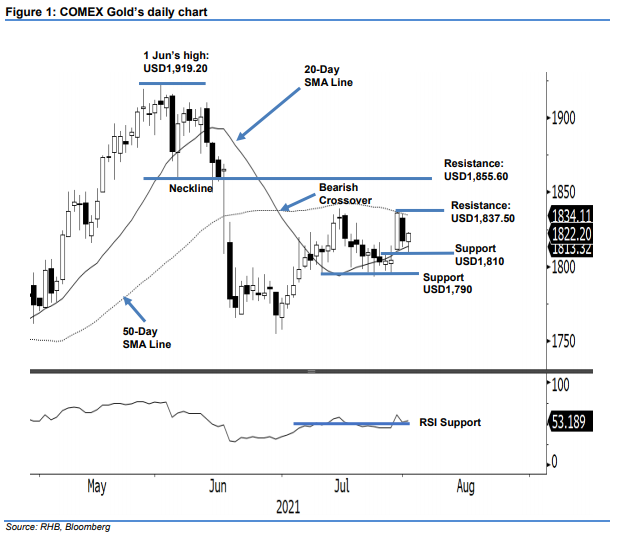

COMEX Gold - Consolidating Near the 20-Day SMA Line Support

rhboskres

Publish date: Tue, 03 Aug 2021, 09:43 AM

Maintain long positions. The COMEX Gold found an interim support at the 20-day SMA line, adding USD5.00 to close at USD1,822.20. It started Monday’s session flat at USD1,817. It dipped to the day’s low of USD1,808.20 before rebounding to test the intraday high of USD1,823.20. It closed at USD1,822.20 after forming a white body candlestick with long lower shadow. The price action reaffirmed that USD1,810 will act as a strong support level. This, coupled with the “higher low” pattern formed near the 20-day SMA line, shows bullish momentum remains intact. We expect bullish momentum to pick up pace again after mild consolidation. Premised on this, we hold on to our positive trading bias.

We recommend traders keep the long positions initiated at USD1,794.20, or 6 Jul’s close. For risk management, the stop-loss threshold is fixed at USD1,790.

The immediate support level is set at USD1,810, followed by a lower support level at USD1,790. On the upside, the immediate resistance is seen at USD1,837.50, or 29 Jul’s high. A higher hurdle is eyed at USD1,855.60, or the neckline that formed on 4 Jun.

Source: RHB Securities Research - 3 Aug 2021