Hang Seng Index Futures - Consolidating Sideways Near 26,000 Pts

rhboskres

Publish date: Tue, 03 Aug 2021, 09:43 AM

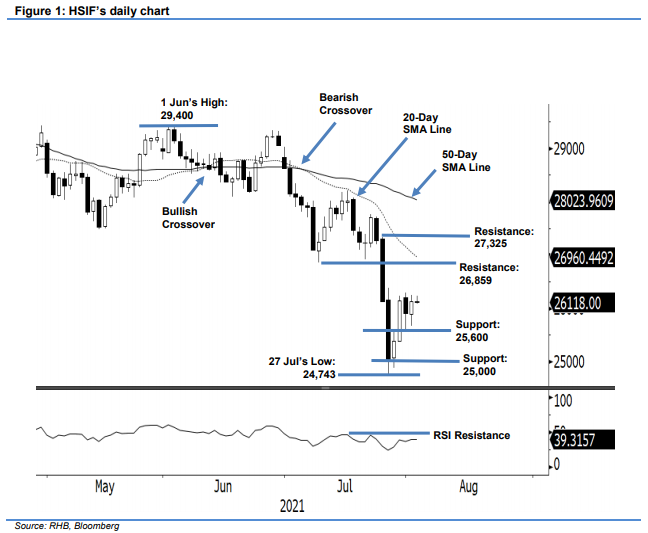

Maintain long positions. The HSIF saw a quiet session yesterday, managing to add 224 pts to settle the day session at 26,121 pts. The index started Monday’s session at 25,970 pts. After dipping to the 25,668-pt day low, it rebounded strongly to the 26,242-pt day high and moved sideways until the end of the day session. During the evening session, the index dipped 3 pts, and was last traded at 26,118 pts. From the latest price action, buying interest has re-emerged near the 25,600-pt support level, printing a “higher low” bullish pattern. If the index sustains above the immediate support level, bullish momentum may improve, leading the index higher in coming sessions – to possibly test the 20-day SMA line. Meanwhile, a breach of the immediate support level would see the index reverting to bearish movement. At this juncture, we maintain our positive trading bias.

Traders should stick with the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To manage risks, the stop-loss is set at 25,330 pts, or the low of 29 Jul.

The immediate support is marked at 25,600 pts, followed by the 25,000-pt psychological level. On the upside, the immediate resistance is pegged at 26,859 pts – the low of 9 Jul – followed by 27,325 pts, or the high of 26 Jul.

Source: RHB Securities Research - 3 Aug 2021