WTI Crude - Strong Profit-Taking Activity Seen

rhboskres

Publish date: Tue, 03 Aug 2021, 09:44 AM

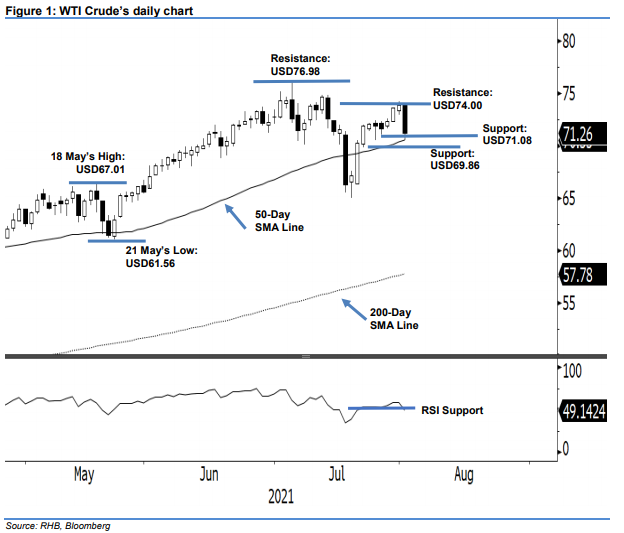

Maintain long positions. After climbing for three consecutive sessions, the WTI Crude saw deep profit-taking activity yesterday, falling USD2.69 to settle at USD71.26. The commodity opened weaker at USD73.91, and touched the day’s high of USD73.95 before selling momentum kicked-in, gradually bringing it lower, ahead of the Asian trading hours. It then whipsawed sideways until the US trading hours started, whereby strong selling pressure emerged, pushing the index to the day’s low of USD70.55. It then bounced off mildly to close at USD71.26. A long bearish candle emerged – with a “bearish engulfing” pattern – signalling negative momentum ahead to test the immediate support of USD71.08, which is also the trailing-stop. Until it breaches the trailing-stop, we stay positive in our trading bias.

We suggest traders stick to the long positions initiated at USD70.30 – the closing level of 21 Jul. To manage trading risks, the trailing stop is marked at USD71.08 or 27 Jul’s low, which is also the immediate support level.

The support levels are fixed at USD71.08 and USD69.86, which was 22 Jul’s low. The next two resistance levels are pegged at USD74.00 and USD76.98 (6 Jul’s high).

Source: RHB Securities Research - 3 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024