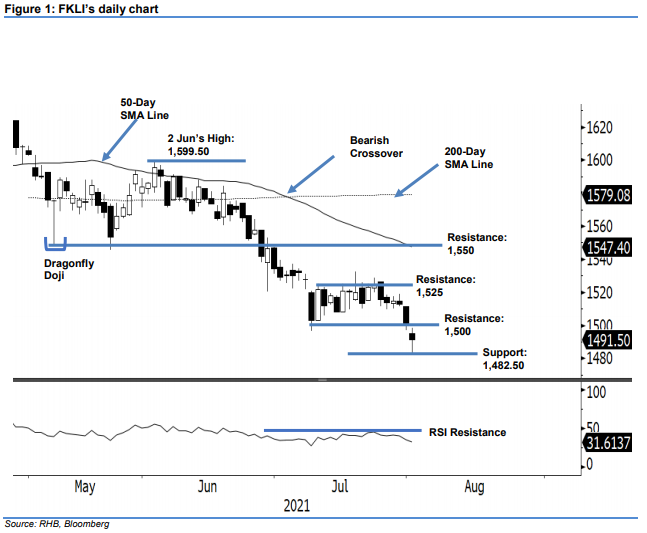

FKLI - Breaching Below 1,500-Pt Level

rhboskres

Publish date: Tue, 03 Aug 2021, 09:47 AM

Maintain short positions. The FKLI declined by 3.50 pts – falling below the 1,500-pt psychological level – and closed at 1,491.50 pts yesterday. The index gapped down on Monday to open weaker at 1,495 pts. Initially, bearish pressure was too strong, dragging the index to touch the 1,482.50-pt day’s low. It then rebounded from the day’s low to close at 1,491.50 pts – printing a Hammer pattern, or long lower shadow candlestick. The bulls attempted to form an interim base at 1,482.50 pts. From here, the bears may take a breather and trigger a technical rebound to retest 1,500-pt level. However, in a typical downtrend market, the resistance level will be strong while the support level tends to be weak. As the RSI is still pointing downwards – pointing to the continuation of negative momentum – we make no change to our negative trading bias now.

Traders should remain in short positions, which were initiated at 1,569.50 pts, or 11 Jun’s close. To control trading risks, our trailing-stop has been adjusted to 1,520 pts.

The immediate support has been revised to 1,482.50 pts the low of 2 Aug, followed by 1,449 pts or the low of Nov 2020. Meanwhile, the immediate resistance is at 1,500 pts, then 1,525 pts or 9 Jul’s high

Source: RHB Securities Research - 3 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024