FKLI - Strong Rebound From The Low

rhboskres

Publish date: Wed, 04 Aug 2021, 04:51 PM

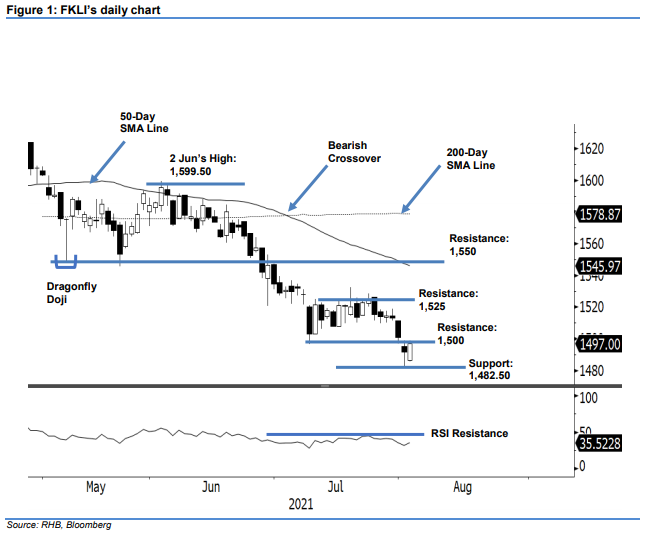

Maintain short positions. The FKLI rebounded strongly yesterday, adding 5.50 pts to settle at 1,497 pts. Initially, the index gapped down to open weaker at 1,486.50 pts. After moving sideways and recording the day’s low at 1,485.50 pts, strong buying interest emerged in the afternoon and lifted the FKLI to test the 1,498.50-pt intraday high before closing – forming a white body candlestick. As mentioned in our previous note, selling pressure is subsiding while the bulls are building their interim base at the immediate support level. With the latest positive price action, the follow-through momentum may lead the index to test the 1,500-pt level. Breaching the psychological level may see sentiment turn bullish again. Until the index has a firm close above the immediate resistance, we maintain a negative trading bias.

We recommend that traders stick to short positions, which were initiated at 1,569.50 pts, or 11 Jun’s close. To manage trading risks, our trailing-stop has been adjusted to 1,508 pts.

The immediate support is marked at 1,482.50 pts – the low of 2 Aug, followed by 1,449 pts or the low of Nov 2020. Conversely, the immediate resistance is pegged at the psychological level of 1,500 pts, then 1,525 pts or 9 Jul’s high.

Source: RHB Securities Research - 4 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024