E-Mini Dow - The Negative Momentum Emerges

rhboskres

Publish date: Thu, 05 Aug 2021, 09:22 AM

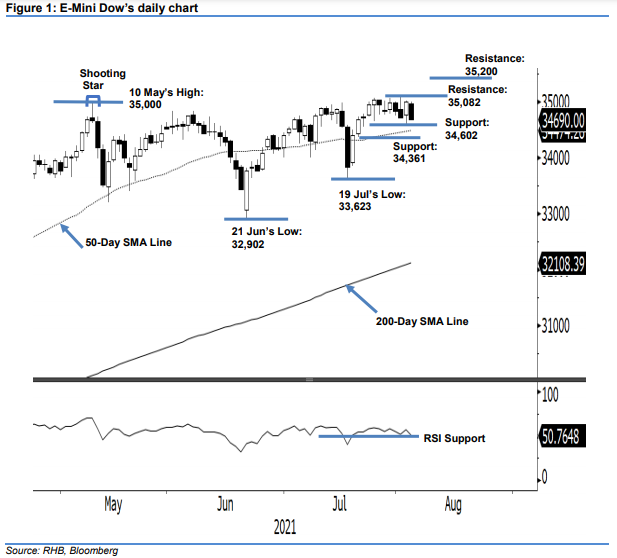

Stop-loss level triggered; initiate short positions. The E-Mini Dow’s positive gain during Tuesday’s session was erased by yesterday’s negative momentum – it declined 308 pts to settle at 34,690 pts. On Wednesday, the index started off at 34,960 pts and, after hovering near 35,000 pts, the E-Mini Dow saw profit-taking activities that brought it down to the 34,674-pt day low before the close. The latest session printed a long black body candlestick, indicating that sentiment had become risk-off yesterday. Coupled with the RSI trending lower, by displaying “lower highs”, the foreseeable negative momentum will follow through in the coming sessions. Breaching the immediate support will lead to further corrections towards the 50-day SMA line, or test the lower support at 34,361 pts. Since the stop-loss threshold is breached, we shift to a negative trading bias.

We closed out the long positions initiated at 34,709 pts, or the closing level of 22 Jul, after the stop-loss mark was triggered at 34,694 pts. Conversely, we initiate short positions at the closing level of 4 Aug, ie 34,690 pts. To manage the trading risks, the initial stop-loss threshold is pegged at 35,082 pts, ie 2 Aug’s high.

The immediate support level is revised to 34,602 pts, or 4 Aug’s low. This is followed by 34,361 pts, which was 21 Jul’s low. The immediate resistance level is eyed at 35,082 pts – the high of 2 Aug – and 35,200 pts, ie the possible new high.

Source: RHB Securities Research - 5 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024