Hang Seng Index Futures - Extending the Technical Rebound

rhboskres

Publish date: Thu, 05 Aug 2021, 09:24 AM

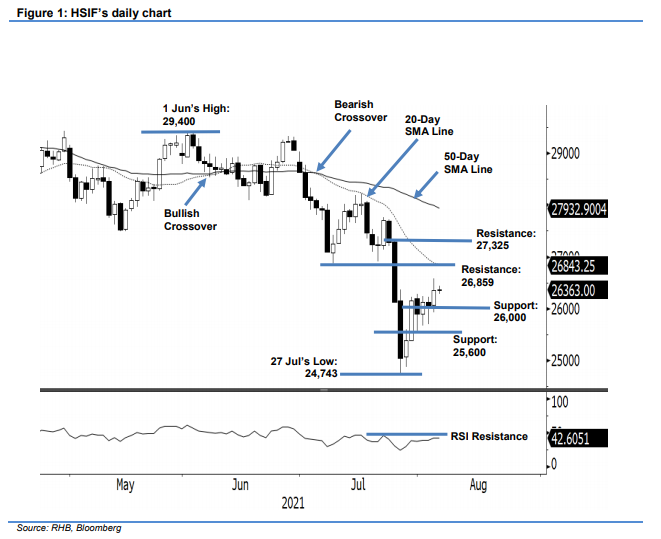

Maintain long positions. The HSIF attempted to extend its technical rebound yesterday, rising 303 pts to settle at 26,358 pts. The index started the day session at 26,026 pts and, after finding its footing at the 25,930-pt day low, it jumped to the 26,584-pt day high before settling in at 26,358 pts. The evening session was neutral, and it last traded at 26,363 pts. With the lastest session, the HSIF has extended its upward movement by printing a fresh “higher low”. The recent price action of a series “higher lows” showed the bullish momentum was gaining traction. If the RSI is able to cross the 50% threshold, the technical setup will get further strengthened. Meanwhile, we do not rule out the possibility of the bears taking profit. However, we believe the 26,000-pt level will act as strong support. As such, we stick with our positive trading bias.

Traders should stick to the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To mitigate the trading risks, the stop-loss mark is revised to 25,600 pts, or the immediate support level.

The immediate support is revised to the 26,000-pt psychological level, followed by the 25,600-pt whole figure. On the upside, the immediate resistance is seen at 26,859 pts – 9 Jul’s low – and followed by 27,325 pts, ie 26 Jul’s high.

Source: RHB Securities Research - 5 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024