FCPO - Breaking Past The MYR4,200 Level

rhboskres

Publish date: Thu, 05 Aug 2021, 09:26 AM

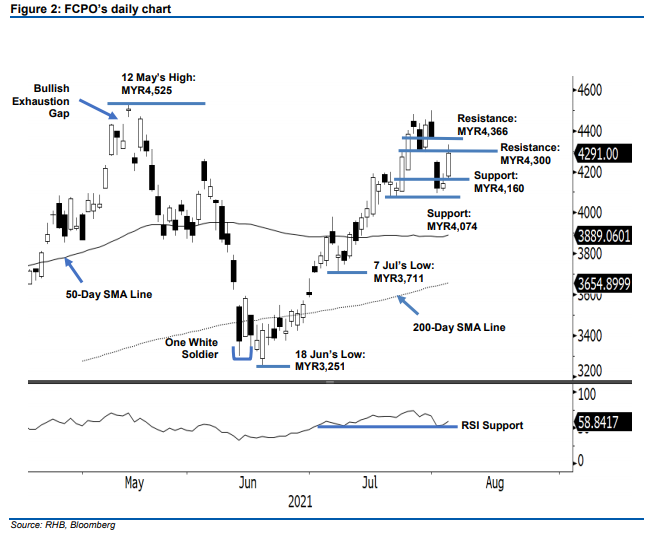

Maintain short positions. The FCPO saw bullish momentum emerge again, breaking past the MYR4,200 level yesterday to settle at MYR4,291 – just shy of the immediate resistance of MYR4,300. The commodity had a strong opening during Wednesday’s session, gapping up to open at MYR4,178. After briefly touching the day’s low of MYR4,160, it progressed towards the day’s high of MYR4,333, before closing at MYR4,291 – forming a long white candlestick. The latest bullish candlestick suggests that recent profit-taking activities are coming to an end, and the commodity poised to rise higher. If the bullish momentum follows through and closes above the MYR4,300 immediate resistance, the bullish technical setup will be strengthened. Before that happens, expect selling pressure to re-emerge near the immediate resistance and hence, we still stick to our negative trading bias.

We recommend traders maintain short positions, initiated at MYR4,308 or the closing level of 28 Jul. To manage risks, the stop-loss is fixed at MYR4,300.

The nearest support level is marked at MYR4,160 the low of 4 Aug, followed by MYR4,074, the low of 22 Jul. Meanwhile, the immediate resistance level is eyed at the MYR4,300 round figure, followed by MYR4,366, or the low of 30 Jul.

Source: RHB Securities Research - 5 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024