Hang Seng Index Futures - Mild Profit-Taking

rhboskres

Publish date: Fri, 06 Aug 2021, 05:19 PM

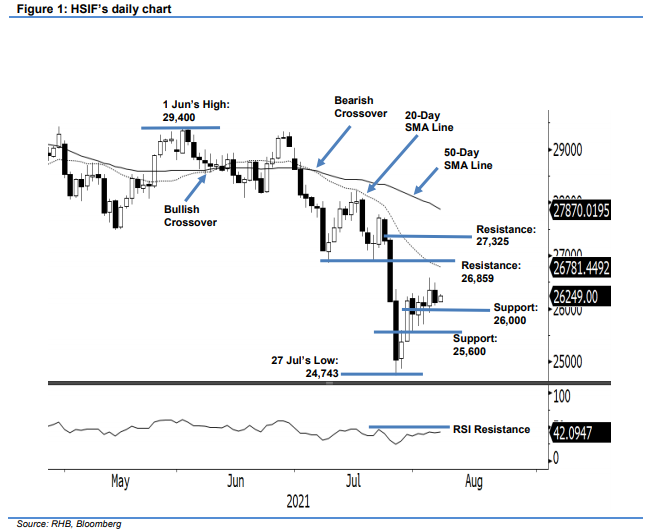

Maintain long positions. The HSIF pulled back from its recent high, declining 233 pts to settle the day session at 26,125 pts. The index started Thursday’s day session at 26,344 pts and rose higher to test the intraday high at 26,486 pts. The bullish momentum halted at the day high then reversed downwards to reach the 26,058-pt day low before the close. The evening session saw the HSIF tracking its US peers’ bullish sentiment to rebound higher and last traded at 26,249 pts. After reaching the recent high of 26,584 pts, the index may drift lower for profit taking. As long as the HSIF does not trend lower to form a fresh “lower low”, we deem the recent technical rebound as intact. The upwards movement may resume in the immediate term. To protect the downside risks, a stop-loss mark is set at the 25,600-pt level. As of now, we still maintain our positive trading bias.

We advise traders to keep to the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. For trading-risk management, the stop-loss mark is set at 25,600 pts, or the immediate support level.

The immediate support is marked at the 26,000-pt psychological level, followed by the 25,600-pt whole figure. On the upside, the immediate resistance is pegged at 26,859 pts – 9 Jul’s low – and followed by 27,325 pts, ie 26 Jul’s high.

Source: RHB Securities Research - 6 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024