WTI Crude - The Bearish Momentum Pauses Near the Immediate Support

rhboskres

Publish date: Fri, 06 Aug 2021, 05:19 PM

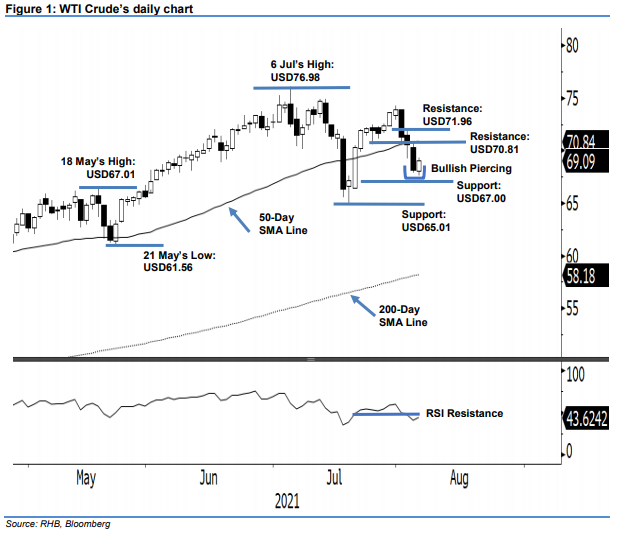

Maintain short positions. After Wednesday’s deep dive, the WTI Crude paused its negative momentum yesterday by bouncing off its intraday low, rising USD0.94 to close at USD69.09. The commodity opened at USD68.06 on Thursday and then whipsawed between the day’s low and high at USD67.61 and USD69.35. The Bullish Piercing candlestick pattern, which formed yesterday, was an early signal that an uptrend reversal may be seen if the WTI Crude breaches the revised USD70.81 immediate resistance level – breaching above the 50-day SMA line. Though we expect the positive momentum to be strengthened in the immediate term, the medium-term technical outlook still remains bearish, as the commodity is trading below the 50-day SMA line. Therefore, we maintain our negative trading bias.

We suggest traders remain in the short positions initiated at USD70.56, ie the closing level of 3 Aug. For risk management, the stop-loss level is revised lower at the USD70.81, or 4 Aug’s high.

The immediate support level is unchanged at the USD67.00 whole number, followed by USD65.01, ie 20 Jul’s low. The next two resistance levels are marked at the USD70.81 and USD71.96, or the highs of 4 Aug and 3 Aug.

Source: RHB Securities Research - 6 Aug 2021