E-Mini Dow - Positive Momentum Re-Emerges Below the Immediate ..

rhboskres

Publish date: Fri, 06 Aug 2021, 05:19 PM

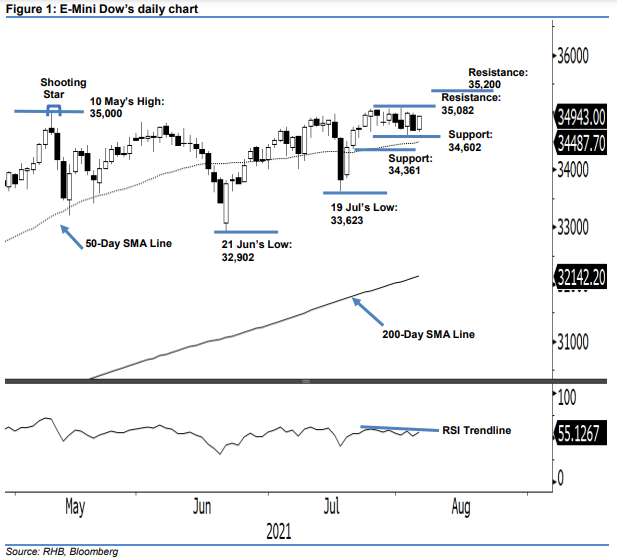

Maintain short positions. After the negative momentum was held on Wednesday, the E-Mini Dow bounced off to erase most of the previous session’s losses to close 253 pts higher at 34,943 pts. The index began at 34,716 pts yesterday. It then whipsawed during the Asian trading session – tapping its day low of 34,667 pts. It then swiftly changed its direction northwards to gradually move higher to reach its 34,949-pt top during the late US trading session before the close. Though the bullish candlestick emerged during the latest session – forming a long white body candlestick pattern – we think it is still early to conclude a reversal to the upward movement, as the E-Mini Dow has yet to print a new “higher high” pattern. Coupled with the RSI trendline pointing downwards, this shows the negative momentum may follow through in the immediate term. At this point in time, we expect the range-bound activities to continue in the coming sessions between the immediate support and resistance levels of 34,602 pts and 35,082 pts. Until the stop-loss mark is hit, we maintain our negative trading bias.

We recommend traders shift to the short positions initiated at the closing level of 4 Aug, or 34,690 pts. To manage the trading risks, the initial stop-loss threshold is marked at 35,082 pts, ie 2 Aug’s high.

The support levels are unchanged at 34,602 pts – 4 Aug’s low – and 34,361 pts, or 21 Jul’s low. The immediate resistance level is maintained at 35,082 pts, or the high of 2 Aug, followed by 35,200 pts – the potential new high.

Source: RHB Securities Research - 6 Aug 2021