FCPO - Eyeing To Cross The MYR4,300 Level

rhboskres

Publish date: Mon, 09 Aug 2021, 09:17 AM

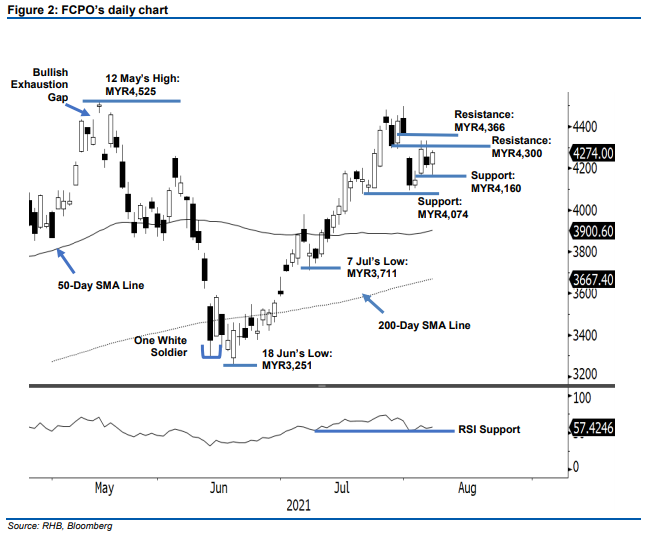

Maintain short positions. The FCPO saw a strong rebound last Friday, rising MYR57.00 to settle at MYR4,274. The commodity started Friday’s session on a stronger note, opening at MYR4,220 and surging to test the MYR4,285 intraday high. The strong opening did not inspire the bulls initially, causing the commodity to retrace and fall to the session’s low of MYR4,169. However, just before closing, a strong positive momentum emerged and lifted the commodity to close at MYR4,274 – higher than the opening level. With the emergence of the positive momentum at the eleventh-hour, the bulls may reclaim the immediate resistance at the MYR4,300-pt level. If the effort proves fruitful, the commodity may progress higher to fill the gap resistance at the MYR4,366-pt level. However, since the MYR4,300-pt level or the stop loss level stays intact for now, we will stick to our negative trading bias until the threshold is breached.

We recommend traders to maintain short positions, initiated at MYR4,308, or the closing level of 28 Jul. To mitigate trading risks, the stop-loss is fixed at MYR4,300.

The immediate support set at MYR4,160, the low of 4 Aug, followed by MYR4,074, the low of 22 Jul. On the upside, the immediate resistance is eyed MYR4,300, followed by the higher hurdle of MYR4,366, or the low of 30 Jul

Source: RHB Securities Research - 9 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024