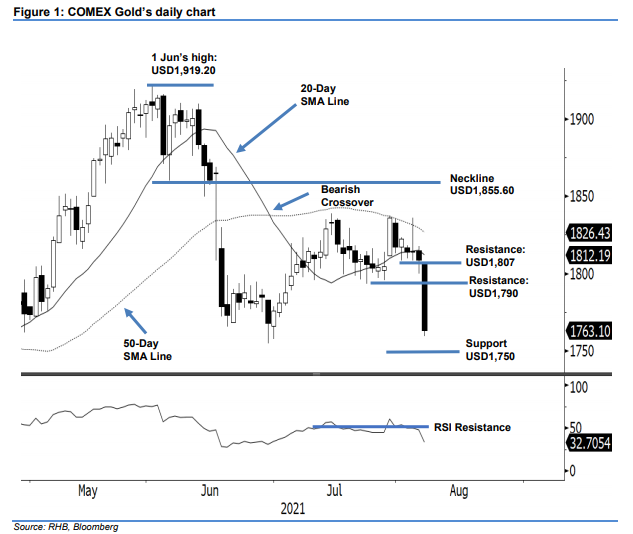

COMEX Gold - Breaching Below the USD1,800 Level

rhboskres

Publish date: Mon, 09 Aug 2021, 09:18 AM

Stop-loss level triggered; initiate short positions. The COMEX Gold saw a major correction last Friday after the 1,790-pt level gave way. The commodity plunged USD45.80 to settle at USD1,763.10. It initially started the session in neutral at USD1,806.70. Just before the US session opened, the COMEX Gold broke below USD1,790 and plummeted to the USD1,759.50 session low before a mild rebound saw it closing at USD1,763.10. With a major correction underway, the commodity may see negative momentum following through to test the USD1,750 level – this is followed by the USD1,730 mark. Selling pressure will persist until it is halted by a bullish reversal candlestick or a candlestick with a long lower shadow. Since the stop-loss threshold has been breached, we are shifting over to a negative trading bias.

We closed out the long positions initiated at USD1,794.20, or 6 Jul’s close, after the stop-loss at USD1,790 was breached. Conversely, we initiate short positions at the closing of 6 Aug, ie USD1,763.10. To manage the trading risks, the initial stop-loss threshold is fixed at USD1,810.

The immediate support level is revised to USD1,750 and followed by the USD1,730 whole number. The immediate resistance is pegged at USD1,790 round number and followed by USD1,807, or 6 Aug’s high

Source: RHB Securities Research - 9 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024