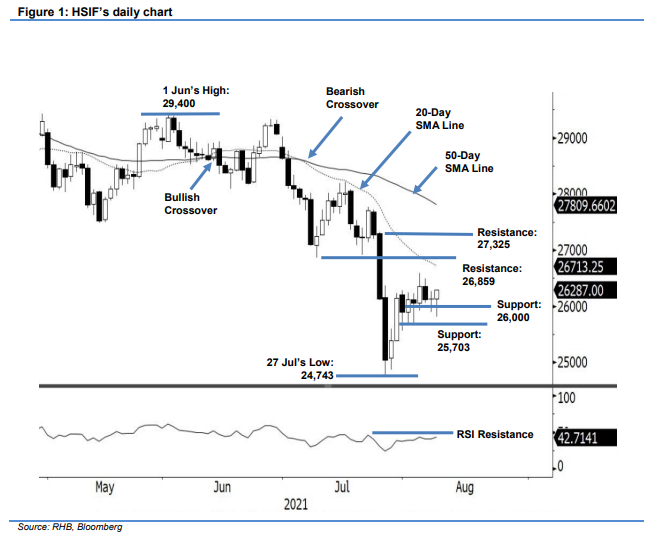

Hang Seng Index Futures - Consolidating Near the 26,000-Pt Level

rhboskres

Publish date: Mon, 09 Aug 2021, 09:19 AM

Maintain long positions. The HSIF consolidated and moved sideways last Friday after adding 4 pts to settle the day session at 26,129 pts. It started this session at 26,207 pts before strong profit-taking during the early session brought it towards the 25,900-pt day low. The bulls then seized the bargains and lifted the HSIF towards the 26,233-pt day high before the close. At the time of writing, it has bounced off the 26,000-pt mark and risen to 26,287 pts. While mild negative momentum was spotted during the latest session, it managed to stay above the 26,000-pt psychological level. If the HSIF continues to stay above the immediate support, the bullish momentum may return – propeling it higher to test the overhead resistance of the 20-day SMA line or the 26,859-pt resistance. As long as the HSIF stays above the stop loss, we believe the technical rebound remains in play – we stick to our positive trading bias.

We recommend traders stay with the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To mitigate the downside risks, the stop-loss mark is raised to 25,703 pts, ie the low of 3 Aug.

The immediate support remains at the 26,000-pt psychological level, followed by 25,703 pts – 3 Aug’s low. On the upside, the immediate resistance is eyed at 26,859 pts – 9 Jul’s low – followed by 27,325 pts, ie 26 Jul’s high.

Source: RHB Securities Research - 9 Aug 2021