E-Mini Dow - Breaking Above The Resistance To Print a New High

rhboskres

Publish date: Mon, 09 Aug 2021, 09:19 AM

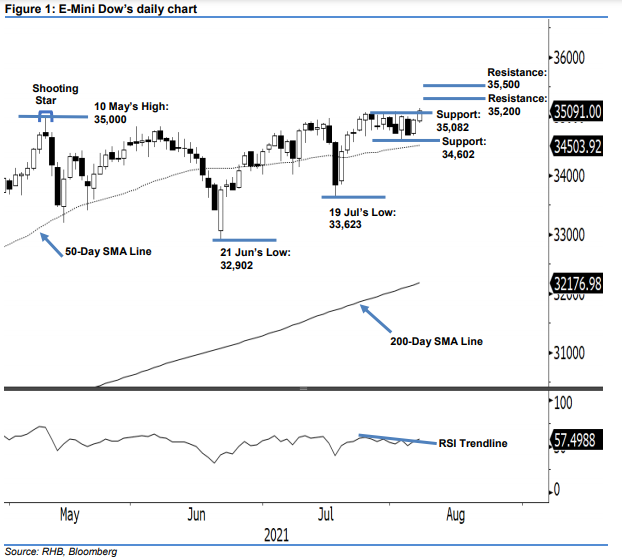

Stop-loss level triggered; initiate long positions. The E-Mini Dow saw a continued rebound last Friday towards uncharted territory as it jumped 148 pts to settle at 35,091 pts. The index started weaker at 34,922 pts and fell towards the 34,883-pt day low. It then gradually climbed higher and reached its day peak during the late session at 35,137 pts before the close. The latest bullish candlestick emerged above the immediate resistance-turned-support level – printing a new “higher high” pattern – which concludes the reversal to the upward movement while charting a new high level. Supported by the RSI pointing upwards – breaking above the recent downward trendline – this shows the positive momentum is set to resume in the immediate term. As it surpassed the historical high level, we expect the E-Mini Dow to continue charting its new high in the coming sessions. Since the stop-loss threshold is breached, we shift from a negative trading bias to a positive one.

We closed out the short positions initiated at the closing level of 4 Aug, or 34,690 pts, after the stop-loss mark was triggered at 35,082 pts. Conversely, we initiate long positions at the closing level of 6 Aug, ie 35,091 pts. To manage the trading risks, the initial stop-loss threshold is pegged at 34,602 pts, or 3 Aug’s low.

The immediate support level is revised at 35,082 pts – 2 Aug’s high – followed by 34,602 pts, ie 3 Aug’s low. The next two resistance levels are marked in uncharted territory: 35,200 pts and 35,500 pts; both are round numbers

Source: RHB Securities Research - 9 Aug 2021