FCPO - Hesistating To Cross The MYR4,300 Level

rhboskres

Publish date: Wed, 11 Aug 2021, 04:50 PM

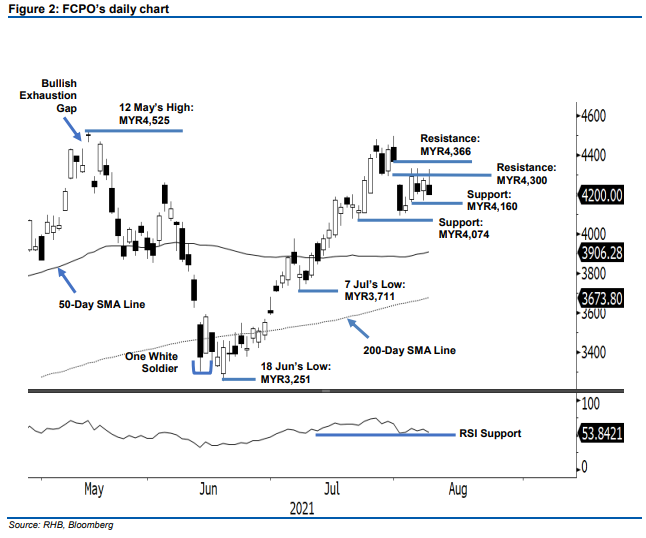

Maintain short positions. The FCPO saw a whipsaw session on Monday, declining MYR74.00 to settle at MYR4,200. The commodity started Monday’s session weaker at MYR4,250 and moved sideways during the morning session. When the session resumed in the afternoon, the commodity jumped to test the MYR4,330 intraday high. However, the strong momentum failed to sustain, resulting in the commodity retracing to the day’s low of MYR4,195 and closing at MYR4,200 – a level near to the day’s low. We view the latest session as dominated by the bears. Since moving into August, the commodity has been printing several “lower high” bearish formations, and has yet to reclaim the gap formed at the MYR4,366 level. If it is able to break past the MYR4,300 immediate resistance level, sentiment may improve to lift the FCPO higher. Otherwise, it may continue to consolidate sideways, positioning it for a downside movement. For now, since the stop-loss remains intact, we make no change to our negative trading bias.

Traders are advised to stick with short positions, initiated at MYR4,308, or the closing level of 28 Jul. To manage trading risks, the stop-loss is set at MYR4,300.

The nearest support is marked at MYR4,160, the low of 4 Aug, followed by the lower support at MYR4,074 or the low of 22 Jul. Towards the upside, the immediate resistance is pegged at MYR4,300, followed by the higher resistance at MYR4,366, or the low of 30 Jul.

Source: RHB Securities Research - 11 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024