COMEX Gold - Attempting to Build An Interim Support

rhboskres

Publish date: Wed, 11 Aug 2021, 04:52 PM

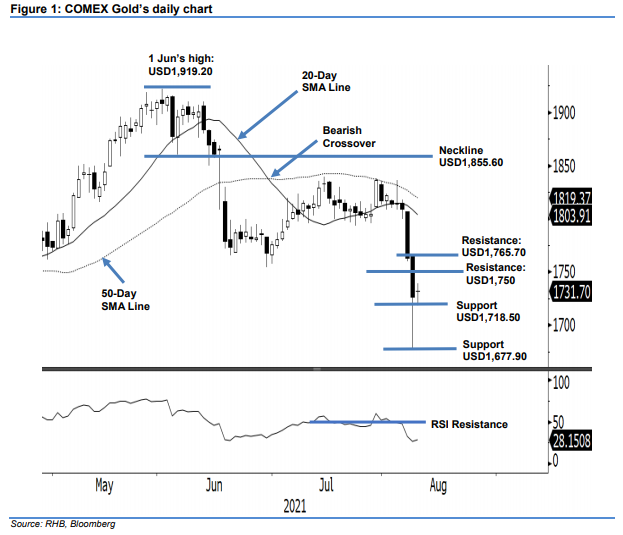

Maintain short positions. After strong selling pressure on Monday, the COMEX Gold found its interim foothold at USD1,677.90 and rebounded strongly with a long lower shadow. Yesterday, the commodity added USD5.20 to settle at USD1,731.70. It started Tuesday’s session at USD1,732 and rose to the session’s high of USD1,739.40. The US trading hours saw selling pressure emerge again, dragging it to the session’s low of USD1,718.50 before closing – forming a Doji pattern. The candlestick indicates that the bulls and bears were at equal strength yesterday. However, the prevailing sentiment is negative, and the RSI falling below the 50% threshold suggests momentum may stay weak for the next few sessions. As such, we expect sideways movement before the commodity retests the upside resistance. For now, we keep our negative trading bias.

We recommend traders shift over to the short positions initiated at the close of 6 Aug, or USD1,763.10. For risk management, the initial stop-loss threshold is placed at USD1,770.

The immediate support level is revised to USD1,718.50 or the low of 10 Aug, followed by USD1,677.90, which was 9 Aug’s low. The immediate resistance is pegged at USD1,750, followed by USD1,765.70, the high of 9 Aug.

Source: RHB Securities Research - 11 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024