WTI Crude - Bulls Emerge Within Downtrend Channel

rhboskres

Publish date: Wed, 11 Aug 2021, 04:53 PM

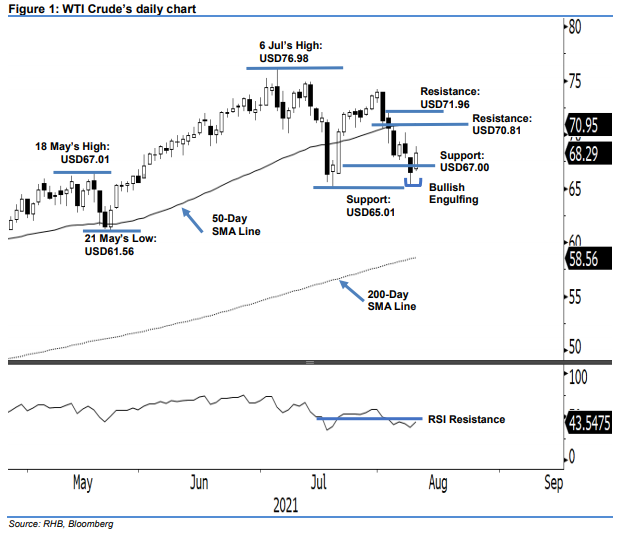

Maintain short positions. Yesterday, the WTI Crude attempted a rebound, bouncing off its immediate support to climb USD1.81 before closing at USD68.29 – still within the recent downtrend line. It started off on a positive note at USD66.85, and whipsawed in an uptrend pattern throughout the session, touching the intraday low of USD66.56 during the morning session before reaching the day’s USD68.90 peak during the US trading hours. While yesterday’s Bullish Engulfing pattern indicates positive momentum in the immediate term, this may not extend to the medium term as it has yet to form a “higher high” pattern (a breach above the immediate resistance level). Also, the RSI is still hovering below the 50% level, despite pointing upwards yesterday. In line with the medium-term momentum – drifting below the immediate resistance – we keep our negative trading bias.

We recommend traders keep the short positions initiated at USD70.56 – the closing level of 3 Aug. For risk management, the stop-loss is set at USD70.81, or 4 Aug’s high.

The immediate support level is maintained at USD67.00, followed by USD65.01 (20 Jul’s low). The resistance levels are marked at USD70.81, or 4 Aug’s high, and USD71.96, which was the high of 3 Aug.

Source: RHB Securities Research - 11 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024