Hang Seng Index Futures - the Bullish Structure Remains

rhboskres

Publish date: Thu, 12 Aug 2021, 05:56 PM

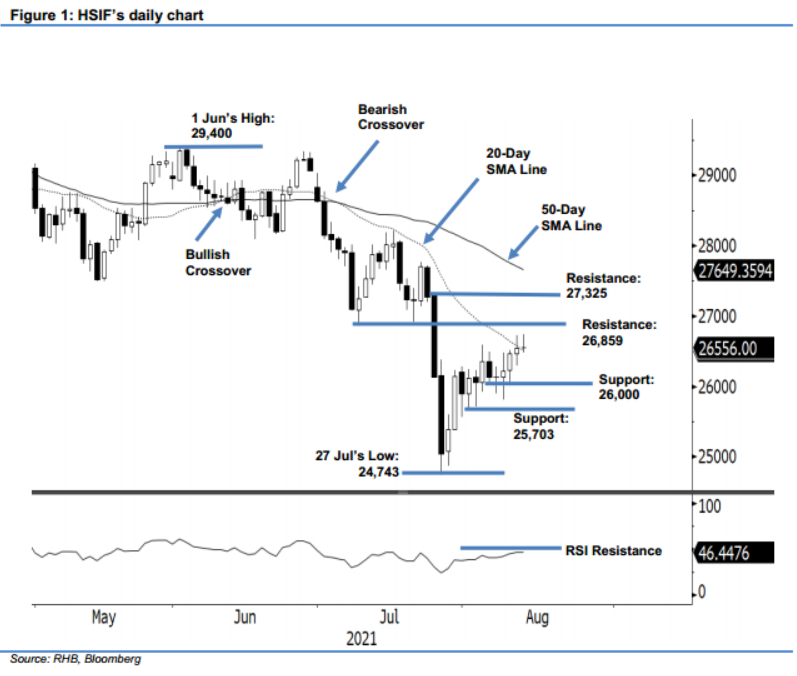

Maintain long positions. The HSIF attempted to extend its upward movement yesterday, rising 79 pts to settle the day session at 26,545 pts. Initially, the early session saw a strong momentum. After the index started at 26,370 pts, it jumped to the 26,722-pt day high. However, the bears took profit near the 20-day SMA line, which saw the HSIF retrace lower in the afternoon before it closed at 26,545 pts. The index added another 11 pts during the evening session and last traded at 26,556 pts. At this juncture, the 20-day SMA line is acting as a strong overhead resistance. This may lead the HSIF to more cosolidations before it can gather the strong momentum needed to breach above the moving average. As long as it continues to form a “higher low” during its consolidations, the bullish structure will remain. As such, we maintain our positive trading bias.

Traders are advised to keep to the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To manage the downside risks, the stop-loss threshold is raised to 25,800 pts.

The immediate support has formed at the 26,000-pt psychological level, followed by 25,703 pts, ie 3 Aug’s low. The nearest resistance is pegged at 26,859 pts – 9 Jul’s low – and followed by 27,325 pts, or 26 Jul’s high.

Source: RHB Securities Research - 12 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024