WTI Crude - Strongly Bouncing Off the Support

rhboskres

Publish date: Thu, 12 Aug 2021, 05:58 PM

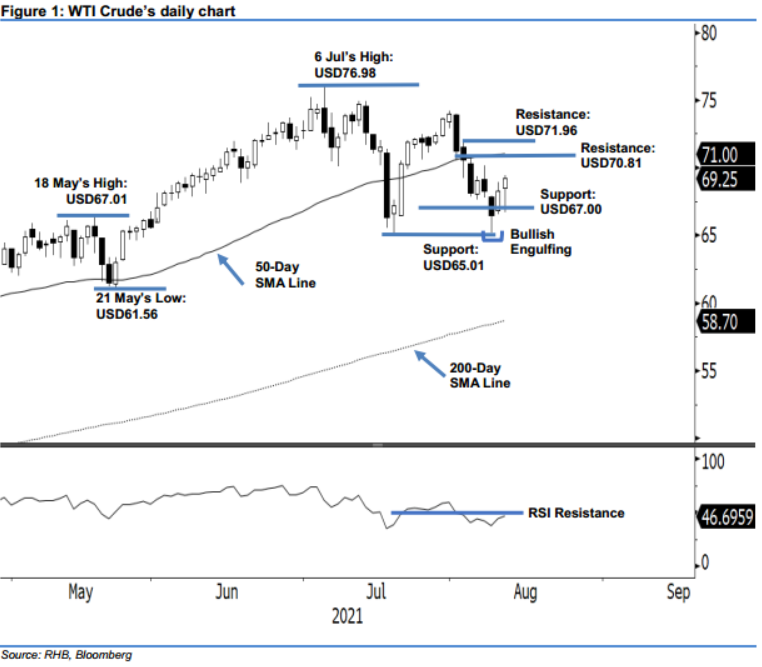

Maintain short positions. The WTI Crude rebounded strongly after bouncing off its intraday low yesterday, closing USD0.96 stronger at USD69.25 – still below the immediate resistance. It began slightly positive at USD68.51 and whipsawed in a sideways direction – this then saw the commodity fall to the day’s bottom of USD66.67 at the start of the European trading session before buying interest re-emerged during the US trading hours – it hit the day’s top of USD69.45 before the close. The bullish candle with long lower shadow that formed yesterday signaled the re emergence of the strong buying interest above the immediate support. Yet, the medium-term bullish momentum can only be seen if it manages to surpass the immediate resistance mark – together with the RSI moving from below to above the 50% level. Until the immediate resistance is breached, we stick to our negative trading bias.

We recommend traders to retain the short positions initiated at USD70.50, or the closing level of 3 Aug. For risk management purposes, the stop-loss threshold is pegged at USD70.81, ie 4 Aug’s high.

The next two support levels are marked at USD67.00 and USD65.01, or 20 Jul’s low. The immediate resistance level is unchanged at USD70.81 – 4 Aug’s high – and followed by USD71.96, or 3 Aug’s high.

Source: RHB Securities Research - 12 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024