E-Mini Dow - the Positive Momentum Accelerates

rhboskres

Publish date: Thu, 12 Aug 2021, 05:58 PM

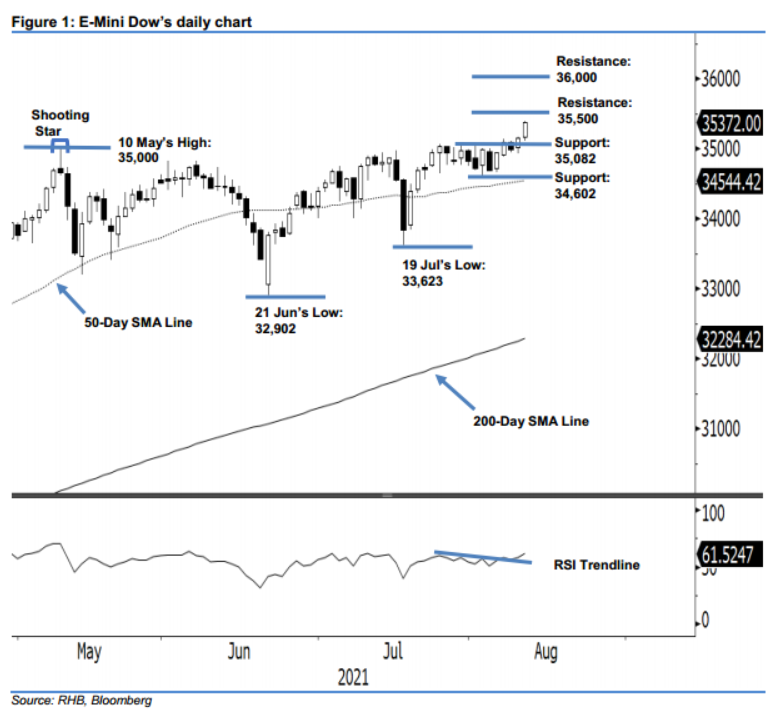

Maintain long positions. After Tuesday’s breakout, the E-Mini Dow continued its bullish momentum yesterday, which saw the index advancing 217 pts to settle at 35,372 pts. After opening higher at 35,164 pts, it retraced mildly towards the 35,106-pt day low. It then swiftly changed direction to the positive after buying interest emerged and hit the day’s top of 35,394 pts – during the US trading session – before the close. The long bullish candlestick that exceeded the previous 35,200-pt resistance level signifies that the “higher high” pattern above the immediate support of 35,082 pts is firming the bullish momentum. This is also in line with the RSI, which is pointing higher above the 60% level – implying that the positive momentum will strengthen further in the immediate term. Hence, we maintain our positive trading bias.

Traders should maintain the long positions initiated at 35,091 pts, or the closing level of 6 Aug. To manage the trading risks, the stop-loss level is revised higher at 35,082 pts, or 2 Aug’s high, ie the immediate support.

The immediate support level is marked at 35,082 pts, or 2 Aug’s high. This is followed by 34,602 pts – 3 Aug’s low. The resistance levels are adjusted higher at 35,500 pts and the 36,000-pt round number.

Source: RHB Securities Research - 12 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024