WTI Crude - Mild Profit-Taking

rhboskres

Publish date: Fri, 13 Aug 2021, 05:46 PM

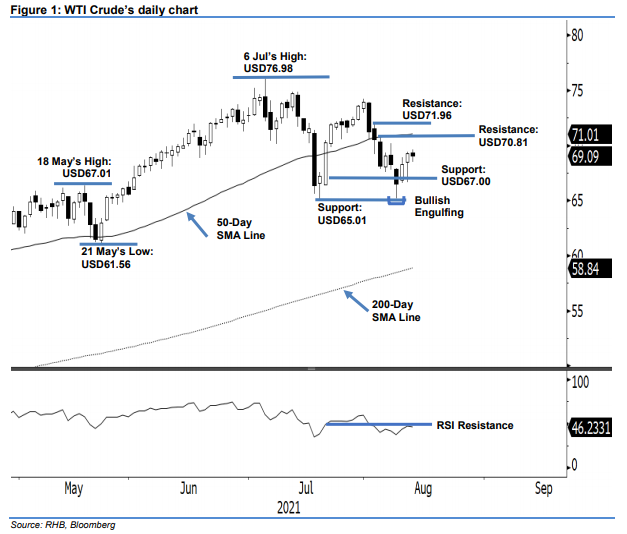

Maintain short positions. After it rebounded strongly on Wednesday, the WTI Crude took a slight profit of USD0.16 yesterday to settle at USD69.09 – pausing the positive momentum. The black gold started slightly positive at USD69.36, but charted choppy throughout the session, which then saw it tapping the day high of USD69.62 at the end of the Asian trading hours. The WTI Crude then fell its USD69.62 low during the US trading session before bouncing off to close at USD69.09. The bearish candle (spinning top) appeared yesterday after the recent bullish move, hinting at continued profit-taking in the coming sessions. With the RSI pointing lower below the 50% level, the bearish momentum for both the immediate and medium terms is getting more obvious. Unless the momentum is reversed, we will stay with our negative trading bias.

We recommend traders stick to the short positions initiated at USD70.50, or 3 Aug’s closing level. For riskmanagement purposes, the stop-loss point is set at USD70.81, ie 4 Aug’s high.

The immediate support level is unchanged at USD67.00 and followed by USD65.01 – 20 Jul’s low. The resistance levels are fixed at USD70.81 – 4 Aug’s high – and USD71.96, which was 3 Aug’s high.

Source: RHB Securities Research - 13 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024