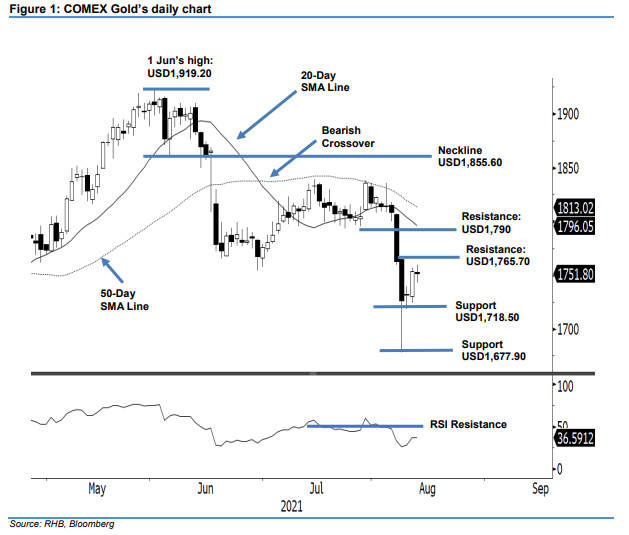

COMEX Gold - Mild Consolidation Near the USD1,750 Level

rhboskres

Publish date: Fri, 13 Aug 2021, 05:47 PM

Maintain short positions. The COMEX Gold moved marginally lower after a lacklustre session on Thursday. The commodity started the session at USD1,752.90, and oscillated between USD1,759.60 and USD1,742.60 before closing at USD1,751.80 – it inched USD1.50 lower from the previous session. Overall, the selling pressure was getting weaker while the buying pressure maintained its strength. If the COMEX Gold is able to surpass USD1,765.70, the bullish momentum will accelerate and lift prices higher. Meanwhile, the yellow metal may continue drifting sidways. Before the stop loss is breached, we make no changes to our negative trading bias.

We advise traders to keep to the short positions initiated at the close of 6 Aug, or USD1,763.10. For risk management, the initial stop-loss threshold is set at USD1,770.

The immediate support level remains at USD1,718.50 – 10 Aug’s low – followed by USD1,677.90, ie 9 Aug’s low. On the upside, the nearest resistance is eyed at USD1,765.70 – 9 Aug’s high – and followed by the USD1,790 round figure.

Source: RHB Securities Research - 13 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024