FCPO - Mild Profit Taking

rhboskres

Publish date: Fri, 13 Aug 2021, 05:47 PM

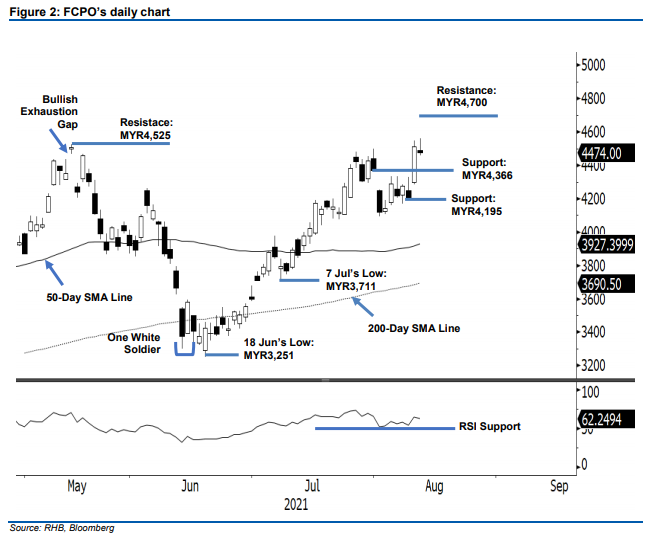

Maintain long positions. The FCPO saw profit taking acitvities near the MYR4,525 level, retracing MYR37 to settle at MYR4,474. After a strong bullish session on Wednesday, the commodity started Thursday’s session weaker, gapping down to open at MYR4,490. After reaching the intraday low of MYR4,460, the commodity rose to test the MYR4,560 intraday high. Profit taking activities brought it lower to close at MYR4,474 – leaving a long upper shawdow. As the RSI is still curving higher, the bullish momentum is deemed intact. An upside movement may resume after the mild profit taking is over. In the event profit taking is extended, the MYR4,366 level will provide support to buffer the selling pressure. Since the commodity is exhibiting a “higher highs with higher lows” bullish pattern, we maintain a positive trading bias.

We recommend traders to shift to long positions initiated at MYR4,511 or the closing level of 11 Aug. For risk management, the initial stop-loss is placed at MYR4,195.

The nearest support is marked at MYR4,366, the low of 30 Jul, followed by the next support of MYR4,195 or the low of 9 Aug. Meanwhile, the immediate resistance is set at MYR4,525, the high of 12 May, followed by MYR4,700.

Source: RHB Securities Research - 13 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024