WTI Crude - Profit Taking Continues

rhboskres

Publish date: Mon, 16 Aug 2021, 09:54 AM

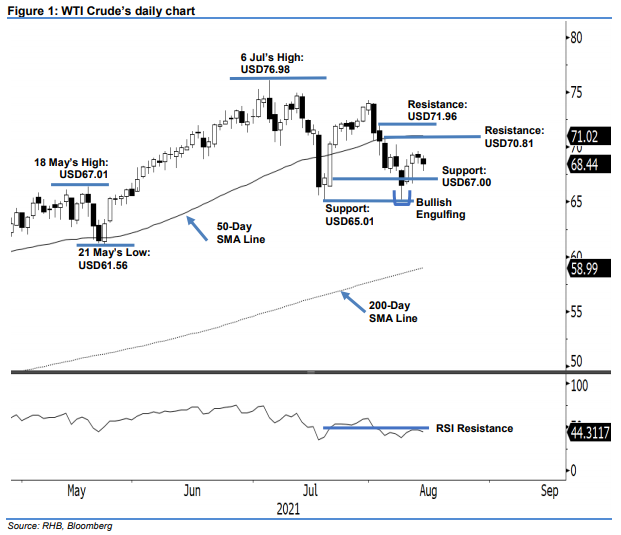

Maintain short positions. The WTI Crude continued to take profits last Friday, which saw it decline by USD0.65 to close at USD68.44 – signalling the bullish momentum remains weak. The black gold opened lower with a gap at USD68.91, which then whipsawed to a downwards pattern throughout the session. It moved lower towards the midAsian trading hours before bouncing off strongly towards the early US trading hours, which tapped the intraday high of USD69.22. However, strong selling pressure emerged, causing the WTI Crude to fall sharply to its USD67.77 low before bouncing off to close at USD68.44. The black body candlestick that emerged last Friday draws a bearish “lower high” pattern below the 50-day SMA line, signifying the downtrend momentum – also in line with the weak RSI below the 50% level. Until the buying momentum re-emerges, we stick to our negative trading bias.

We suggest traders maintain short positions initiated at USD70.50, or 3 Aug’s closing level. For risk-management purposes, the stop-loss threshold is marked at USD70.81, or 4 Aug’s high.

The support levels remain at USD67.00 and USD65.01, ie 20 Jul’s low. The immediate resistance level is unchanged at USD70.81 – 4 Aug’s high – and followed by USD71.96, or 3 Aug’s high.

Source: RHB Securities Research - 16 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024