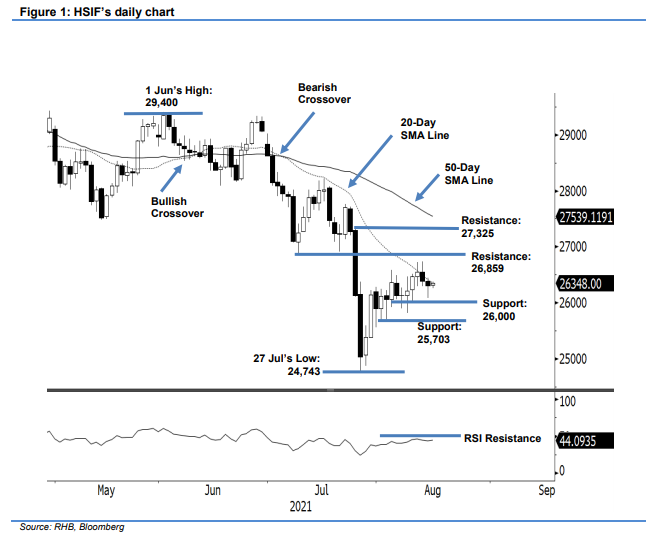

Hang Seng Index Futures - Struggling Near the 20-Day SMA Line

rhboskres

Publish date: Mon, 16 Aug 2021, 09:55 AM

Maintain long positions. The HSIF upside movement was rejected by the 20-day SMA line, retracing 78 pts to settle the day session at 26,310 pts. It began Friday’s session weaker at 26,194 pts. After it found the 26,081-pt day low, it rebounded sharply to the 26,444-pt day high. However, the bulls wavered near the 20-day SMA line and the index closed lower at 26,310 pts. It recouped 38 pts during the evening session to close at 26,348 pts. As the 20-day SMA line is trending lower, the selling pressure along the moving average is increasing while dragging the HSIF lower. It may consolidate near 26,000 pts before another attempt is made to cross the overhead resistance. Meanwhile, the latest session printed a long lower shadow, extending its “higher low” bullish pattern. As such, the counter-trend rebound that started from 24,743 pts is deemed uninterrupted and we stick to our positive trading bias.

Traders are recommended to keep the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To control the trading risks, the stop-loss threshold is placed at 26,000 pts.

The immediate support sticks to the 26,000-pt psychological level, followed by 25,703 pts, or 3 Aug’s low. Meanwhile, the nearest resistance is unchanged at 26,859 pts – 9 Jul’s low – followed by 27,325 pts, ie 26 Jul’s high.

Source: RHB Securities Research - 16 Aug 2021