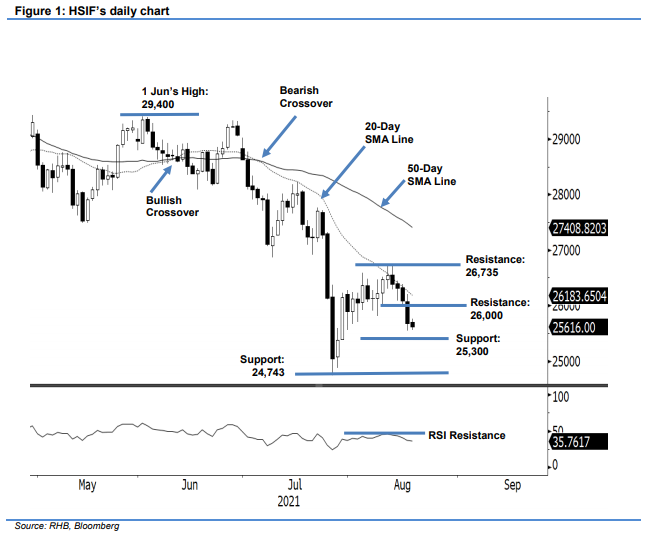

Hang Seng Index Futures - Breaching Below the 26,000-Pt Psychological Level

rhboskres

Publish date: Wed, 18 Aug 2021, 05:41 PM

Stop loss triggered; initiate short positions. The HSIF saw negative momentum accelerate yesterday, falling 405 pts to settle the day session at 25,683 pts. The index started the session mildly stronger at 26,100 pts and rose to test the 26,200-pt day high. After touching the intraday high, it progressed lower. Selling pressure accelerated after the HSIF breached the 26,000-pt psychological level, plummeting to the 25,550-pt day low before the close. It dropped further in the evening session to close at 25,616 pts. It is apparent now that the index failed to cross above the 20-day SMA line due to weak momentum. As the RSI is rounding lower, negative momentum is increasing and may follow through to drag the HSIF lower. Since the stop loss is breached, we shift over to a negative trading bias.

We closed out the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session after the stop-loss level at 26,000 pts was triggered. Conversely, we initiate short positions at the closing level of 17 Aug. To manage the trading risks, the initial stop-loss threshold is set at 26,450 pts.

The immediate support is projected at the 25,300-pt round figure, followed by 24,743 pts, ie 27 Jul’s low. The immediate resistance is pegged at 26,000 pts – the psychological level – followed by 26,735 pts, or 12 Aug’s high.

Source: RHB Securities Research - 18 Aug 2021