E-Mini Dow - Profit Taking Towards the Immediate Support

rhboskres

Publish date: Wed, 18 Aug 2021, 05:41 PM

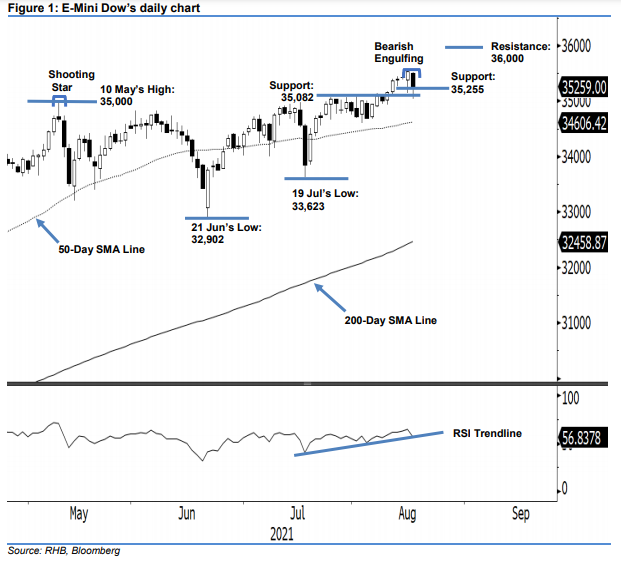

Maintain long positions. Despite recording the new high on Tuesday, the E-Mini Dow reversed its momentum yesterday, falling 275 pts to close at 35,259 pts – a mere 4 pts above the trailing stop. It opened lower at 35,508 pts – merely tapping the 35,516-pt day high – which then saw selling pressure continuing to dominate throughout the session to hit the intraday low of 35,034 pts before bouncing off in the mid-US trading session. It closed at USD35,259. The black body candlestick that closed lower than Tuesday’s bullish candle draws a Bearish Engulfing pattern – fading away the recent bullish momentum. This negative price action is also supported by the weaker RSI strength – from above to below the 60% level, ie in line with our expectation of increased volatility, which led us to lower the trailing stop earlier. Since the latter has yet to be breached, we maintain our positive trading bias.

Traders should stay in the long positions initiated at 35,091 pts, or the closing level of 6 Aug. To mitigate the trading risks, the trailing-stop level is pegged at 35,255 pts, ie 12 Aug’s low – the immediate support.

The immediate support level is unchanged at 35,255 pts, or 12 Aug’s low, and is followed by 35,082 pts – 2 Aug’s high. The resistance levels are marked at 36,000 pts and 36,500 pts – both are round numbers.

Source: RHB Securities Research - 18 Aug 2021