WTI Crude - Bears Test the USD65.01 Immediate Support

rhboskres

Publish date: Thu, 19 Aug 2021, 05:54 PM

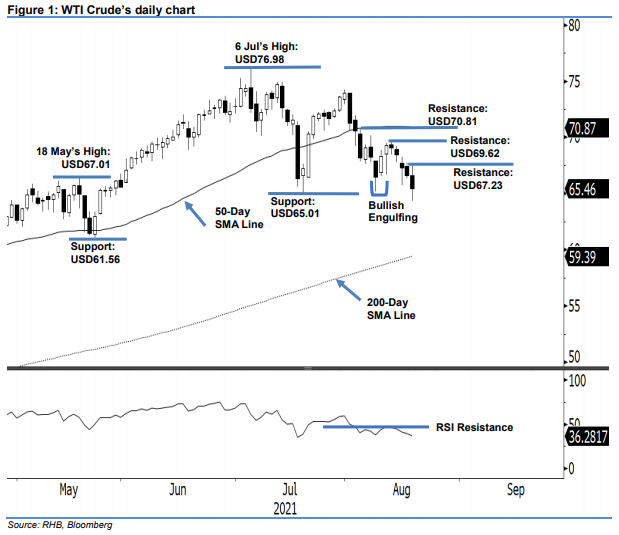

Keep short positions. Despite attempting to move higher yesterday, the WTI Crude pared the intraday gains and continued its downtrend as it fell USD1.13 to close at USD65.46 – tapping its USD65.01 immediate support. It opened neutral at USD66.58 and fell slightly lower before the Asian trading session started. Buying pressure then emerged to uplift the commodity higher towards the day’s peak at USD67.48 before the US trading session began. This was shortlived, however, as selling pressure re-emerged – this then saw the WTI Crude fall sharply towards the day’s bottom of USD64.34 before its close. The black body candlestick nearing the immediate support level suggests the negative momentum, which kicked in below USD67.00 recently, may breach the immediate support in the coming sessions. Coupled with the weaker RSI below the 40% level, we retain our bearish trading bias.

We suggest traders stick to the short positions initiated at USD70.50, or 3 Aug’s closing level. To manage risks, the stop-loss level is marked at USD69.62, or 12 Aug’s high.

The immediate support level is pegged at USD65.01 – 20 Jul’s low – followed by USD61.56, or 21 May’s low. The resistance levels are marked at USD67.23 – 18 Aug’s high – and USD69.62, ie 12 Aug’s high.

Source: RHB Securities Research - 19 Aug 2021