E-Mini Dow- Bullish Momentum Extends

rhboskres

Publish date: Wed, 25 Aug 2021, 11:27 AM

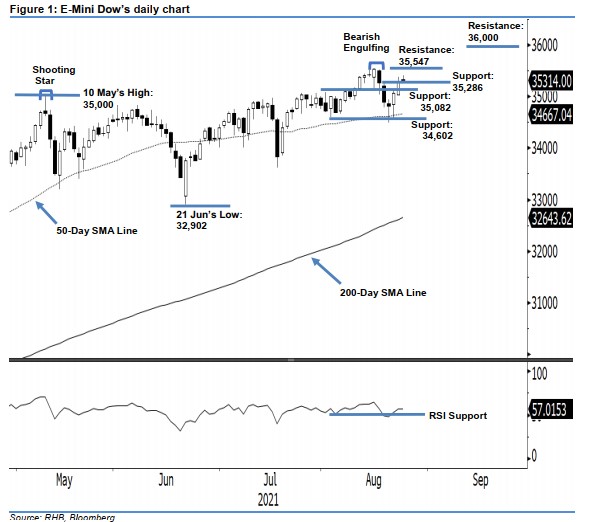

Stop-loss triggered; initiate long positions. Yesterday, the E-Mini Dow continued its mild positive momentum – despite intra-day profit taking – inching up 33 pts to close at 35,314 pts. It started on a positive note, at 35,328 pts, before attempting to move higher – touching the 35,373-pt day high. The upward movement was shortlived, as bearish momentum emerged during the Asian trading hours, sending the index to the session’s low of 35,293 pts. It then bounced off mildly and whipsawed towards the close. The latest pattern – a black body candle with a long upper shadow – above the breakout level, suggests that the bulls are back in the driver’s seat and eyeing the immediate resistance of 35,547 pts. However, we do not discount the possibility of more profit-taking in the coming sessions, and expect the 35,082-pt level to act as a strong support. As the E-Mini Dow has crossed the stop-loss, we switch from a negative to positive trading bias.

We closed out the short positions initiated at 34,887 pts or 18 Aug’s closing level, after the stop-loss at 35,286 pts or 18 Aug’s high was triggered. Conversely, we initiate long positions at the closing level of 24 Aug, or 35,314 pts. To mitigate risks, the initial stop-loss is marked below 35,000 pts.

The immediate support is revised to 35,286 pts, or 18 Aug’s high, with the lower support at 35,082 pts, or 2 Aug’s high. The immediate resistance is pegged at 35,547 pts – 16 Aug’s high – followed by the 36,000-pt round figure.

Source: RHB Securities Research - 25 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024